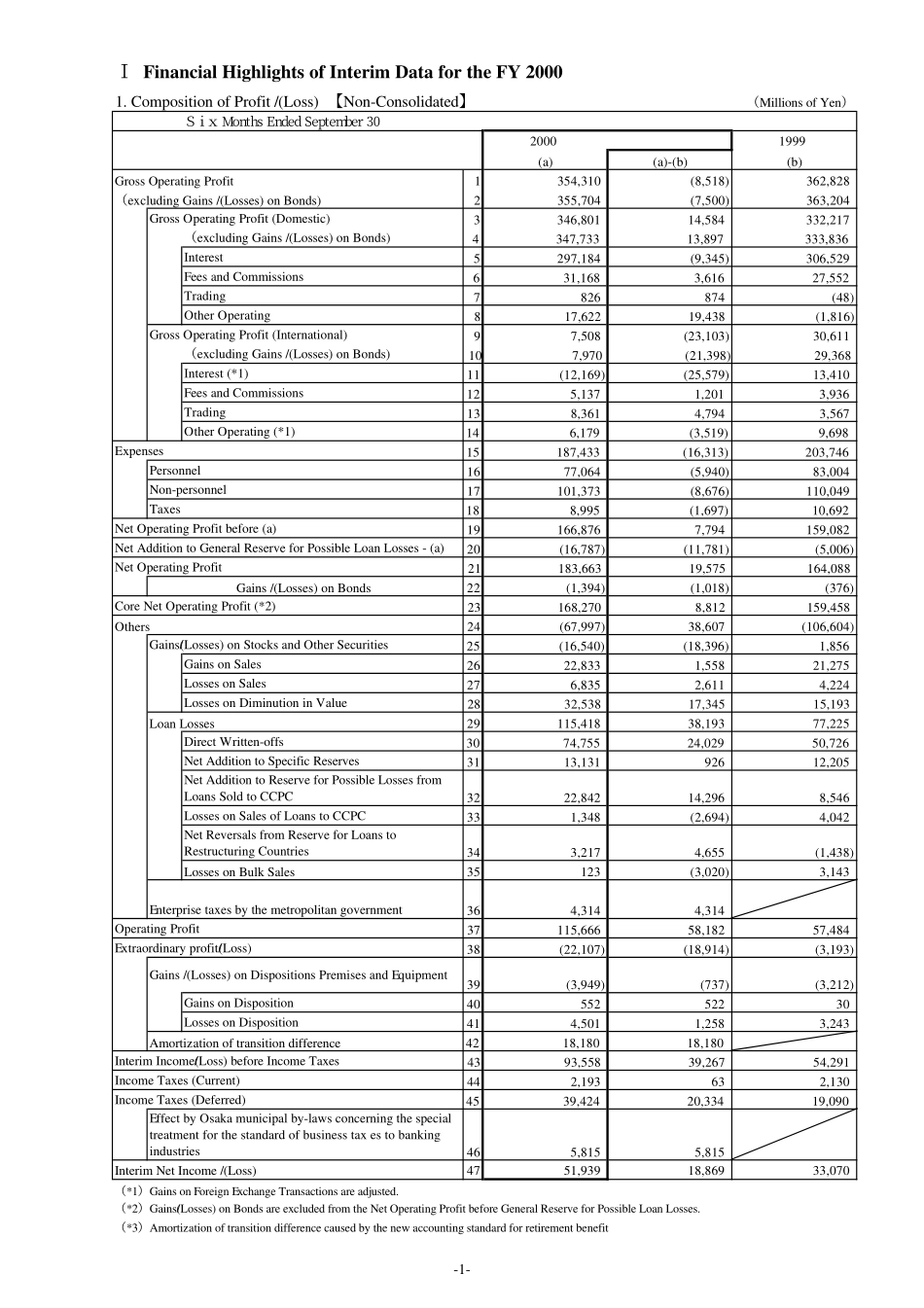

InterimFinancialResultsReportApril-September2000-ReferenceMaterials-TheSakuraBank,Limited【【【【CONTENTS】】】】ⅠⅠⅠⅠFinancialHighlightsofInterimDatafortheFY20001CompositionofProfit/(Loss)Non-Consolidated1Consolidated22NetOperatingProfitPerEmployeeandExpenseRatioNon-Consolidated33Yield(Domestic)Non-Consolidated4Gains/(Losses)onSecuritiesNon-Consolidated5EvaluationGains/(Losses)onSecuritiesConsolidated,Non-Consolidated46CapitalRatio(BISGuidelines)Consolidated57ROEConsolidated,Non-Consolidated8RetirementBenefitConsolidated,Non-Consolidated6ⅡⅡⅡⅡLoans-1Risk-MonitoredLoansConsolidated,Non-Consolidated72ReserveforPossibleLoanLossesConsolidated,Non-Consolidated83ReserveRatiotoRisk-MonitoredLoansConsolidated,Non-Consolidated4DisclosurebasedonFinancialRevitalizationLawNon-Consolidated95StatusofCoverageaccordingtoFinancialRevitalizationLawNon-Consolidated6ComparisonofSelf-AssessmentandDisclosedAssetNon-Consolidated107InformationonLoanbyIndustry-11①LoansandBillsDiscountedbyIndustryNon-Consolidated②Risk-MonitoredLoansbyIndustryNon-Consolidated③DisclosurebasedonFinancialRevitalizationLawbyIndustryNon-Consolidated128InformationonLoanbyArea-13①LoanstoRestructuringCountriesNon-Consolidated②LoanBalancetoAsianCountriesNon-Consolidated③LoanBalancetoLatinAmericaNon-Consolidated14④LoanBalancetoRussiaNon-Consolidated⑤DisclosurebasedonFinancialRevitalizationLawbyAreaNon-Consolidated9InformationonDepositsandLoans-15①DepositandLoanBalanceNon-Consolidated②LoanstoIndividualsNon-Consolidated③LoansandBillsDiscountedtoSmallandMedium-sizedEnterprisesNon-Consolidated10ExpensesNon-Consolidated1611NumberofEmployeesandDirectorsNon-Consolidated12NumberofOfficesNon-ConsolidatedⅢⅢⅢⅢPerformanceProjectionforFY2000-1Profit/(Loss)Consolidated,Non-Consolidated172CapitalRatio(BISGuidelines)ConsolidatedⅠFinancialHighlightsofInterimDatafortheFY20001.CompositionofProfit/(Loss)【Non-Consolidated】(MillionsofYen)SixMonthsEndedSeptember3020001999(a)(a)-(b)(b)GrossOperatingProfit1354,310(8,518)362,828(excludingGains/(Losses)onBonds)2355,704(7,500)363,204GrossOperatingProfit(Domestic)3346,80114,584332,217(excludingGains/(Losses)onBonds)4347,73313,897333,836Interest5297,184(9,345)306,529FeesandCommissions631,1683,61627,552Trading7826874(48)OtherOperating817,62219,438(1,816)GrossOperatingProfit(International)97,508(23,103)30,611(excludingGains/(Losses)onBonds)107,970(21,398)29,368Interest(*1)11(12,169)(25,579)13,410FeesandCommissions125,1371,2013,936Trading138,3614,7943,567OtherOperating(*1)146,179(3,519)9,698Expenses15187,433(16,313)203,746Personnel1677,064(5,940)83,004Non-personnel17101,373(8,676)110,049Taxes188,995(1,697)10,692NetOperatingProfitbefore(a)19166,8767,794159,082NetAdditiontoGeneralReserveforPossibleLoanLosses-(a)20(16,787)(11,781)(5,006)NetOperatingProfit21183,66319,575164,08822(1,394)(1,018)(376)CoreNetOperatingProfit(*2)23168,2708,812159,458Others24(67,997)38,607(106,604)Gains/(Losses)onStocksandOtherSecurities25(16,540)(18,396)1,856GainsonSales2622,8331,55821,275LossesonSales276,8352,6114,224LossesonDiminutioninValue2832,53817,34515,193LoanLosses29115,41838,19377,225DirectWritten-offs3074,75524,02950,726NetAdditiontoSpecificReserves3113,13192612,205NetAdditiontoReserveforPossibleLossesfromLoansSoldtoCCPC3222,84214,2968,546LossesonSalesofLoanstoCCPC331,348(2,694)4,042N...