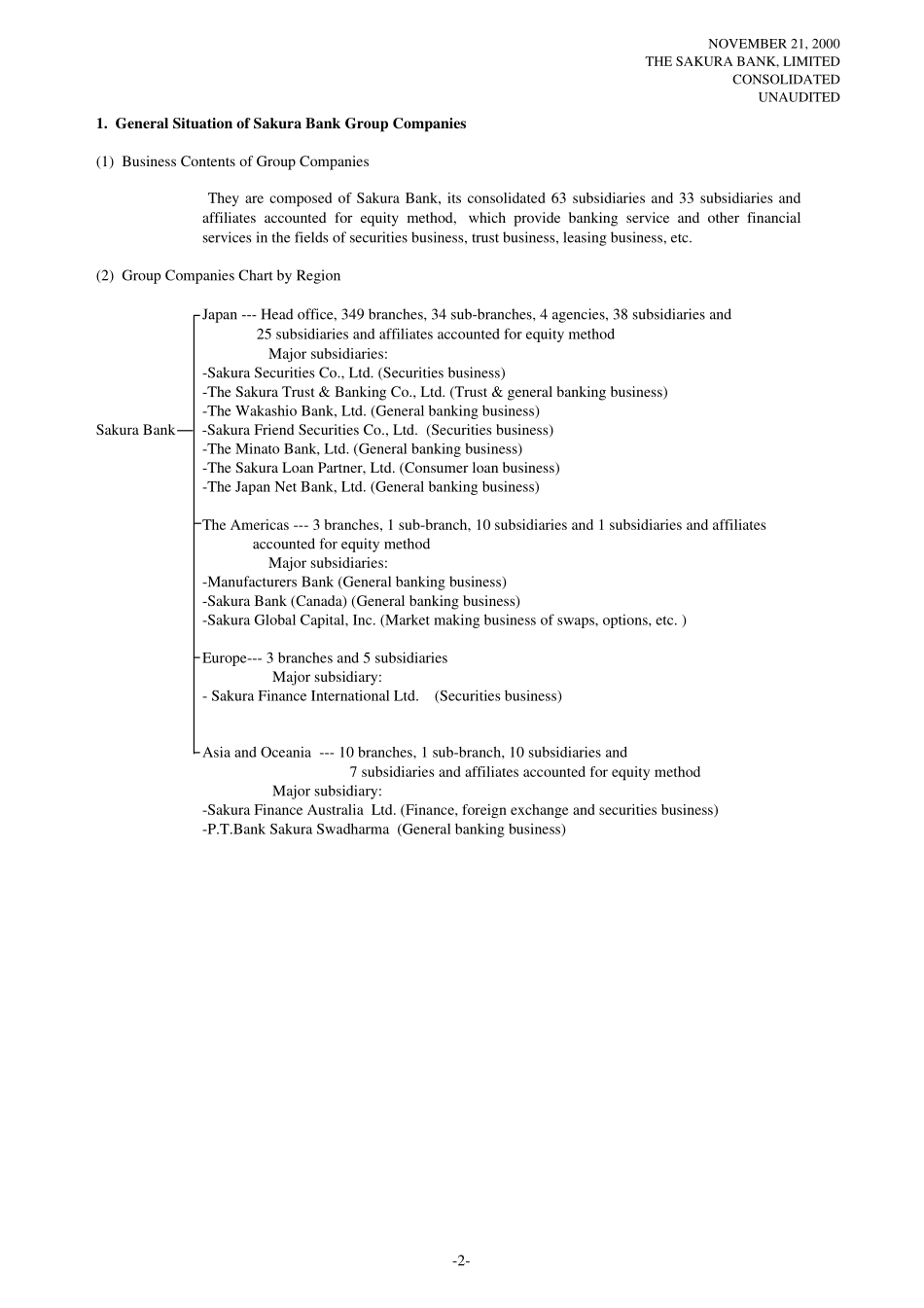

NOVEMBER21,2000THESAKURABANK,LIMITEDCONSOLIDATEDUNAUDITEDTHESAKURABANK,LIMITEDSUMMARYOFCONSOLIDATEDACCOUNTSFORTHEPERIODFROMAPRIL1,2000TOSEPTEMBER30,2000CORPORATEANDSTOCKINFORMATIONHEADOFFICE:Tokyo,JapanACCOUNTINGPERIOD:YearEndingMarch31DATEOFAPPROVALBYTHEBOARDOFDIRECTORS:NOVEMBER21,20001.PERFORMANCE(FORTHEPERIODFROMAPRIL1,2000TOSEPTEMBER30,2000)(1)PRINCIPALINDICATORSSixMonthsEndedSeptember30YearsEndedMarch31MillionsofYen2000Inc./(Dec.)*1999Inc./(Dec.)*2,000Inc./(Dec.)*OperatingIncome881,178(3.4%)911,831-2,147,4950.4%OperatingProfit105,99943.1%74,075-136,497-NetIncome31,302(23.3%)40,803-62,581-NetIncomePerShare(Yen)6.268.6312.58NetIncomePerShareAfterAssumingDilution(yen)6.258.56-*Changefromtheprevious(interim)termNotes:1.Figureslessthanonemillionareroundeddown.2.Equityinearnings/lossesofaffiliatedcompaniesasofSeptember30,2000:JPY7,443million(earnings)asofSeptember30,1999:JPY347million(earnings)asofMarch31,2000:JPY1,487million(losses)3.UnrealizedGainsonDerivativeFinancialInstrumentsasofSeptember30,2000:JPY19,142million4.AccountingproceduresareinaccordancewithgenerallyacceptedstandardsforpreparationoffinancialaccountsinJapanandexplainedindetailinnotestobalancesheetandstatementofincome.(2)FINANCIALPOSITIONSeptember30March31MillionsofYen200019992,000TotalAssets50,713,08048,825,91548,495,608Stockholders'Equity2,183,7522,202,5502,208,554EquityRatio4.3%4.5%4.6%Stockholders'EquityperShare(yen)335.35338.30340.98CapitalRatio(BISGuidelines)(preliminary)12.30%12.43%12.53%(3)CASHFLOWSSTATEMENTSeptember30March31MillionsofYen200019992,000CashFlowsfromOperatingActivities111,788444,452888,743CashFlowsfromInvestingActivities(314,879)(379,406)(367,609)CashFlowsfromFinancingActivities(110,547)31,217(22,124)CashandCashEquivalentsatEndofYear1,094,4551,003,9971,408,146(4)APPLICATIONOFCONSOLIDATEDANDEQUITYMETHODS(a)NumberofConsolidatedSubsidiaries:63(b)NumberofUnconsolidatedSubsidiariesAccountedforEquityMethod:23(c)NumberofAffiliatedCompaniesAccountedforEquityMethod:10(5)CHANGESUNDERAPPLICATIONOFCONSOLIDATEDANDEQUITYMETHODS(a)AddednumberofConsolidatedSubsidiaries:13(b)ExcludednumberofConsolidatedSubsidiaries:1(c)AddednumberofAffiliatedCompaniesAccountedforEquityMethod:2(d)ExcludednumberofAffiliatedCompaniesAccountedforEquityMethod:12.PERFORMANCEPROJECTIONFORFY2000(YEARTHROUGHMARCH31,2001)MillionsofYenOperatingIncome1,700,000OperatingProfit225,000NetIncome72,000(reference)ForecastofnetincomepershareisJPY14.82.Notes:Forecastednetincomepershareiscalculatedwithouttakingconversionofpreferencestockstocommonstocksintoconsideration.-1-NOVEMBER21,2000THESAKURABANK,LIMITEDCONSOLIDATEDUNAUDITED1.GeneralSituationofSakuraBankGroupCompanies(1)BusinessContentsofGroupCompaniesTheyarecomposedofSakuraBank,itsconsolidated63subsidiariesand33subsidiariesandaffiliatesaccountedforequitymethod,whichprovidebankingserviceandotherfinancialservicesinthefieldsofsecuritiesbusiness,trustbusiness,leasingbusiness,etc.(2)GroupCompaniesChartbyRegionJapan---Headoffice,349branches,34sub-branches,4agencies,38subsidiariesand25subsidiariesandaffiliatesaccountedforequitymethodMajorsubsidiaries:-SakuraSecuritiesCo.,Ltd.(Securitiesbusiness)-TheSakuraTrust&BankingCo.,Ltd.(Trust&generalbankingbusiness)-TheWakashioBank,Ltd.(Generalbankingbusiness)SakuraBank-SakuraFriendSecuritiesCo.,Ltd.(Securitiesbusiness)-TheMinatoBank,Ltd.(General...