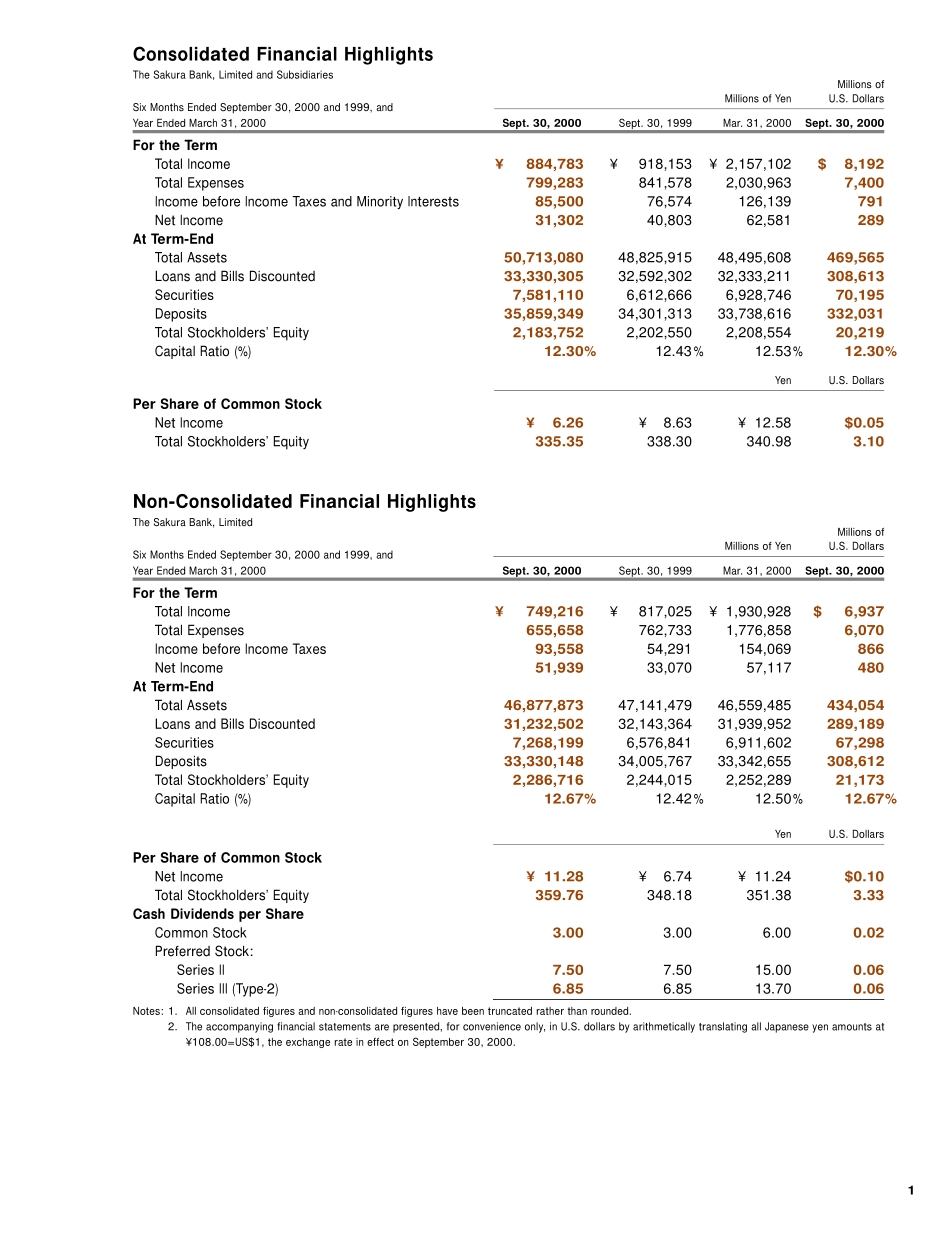

INTERIMFINANCIALREPORTApril–September200032Profile(AsofSeptember30,2000)YearsEndedMarch31,1999and1998HeadOffice3-1,KudanMinami1-chome,Chiyoda-ku,Tokyo100-8611,JapanTel:+81332303111Telex:J22378MITKBKEstablished1876TotalAssets(Non-Consolidated)¥46,877.8billionDeposits(Non-Consolidated)¥33,330.1billionLoansandBillsDiscounted(Non-Consolidated)¥31,232.5billionCapitalStock(Non-Consolidated)¥1,042.7billionDomesticNetworkBranches350Sub-branches34Agencies4OverseasNetworkBranches16Sub-branches2Representativeoffices6ConsolidatedSubsidiaries63SubsidiariesandAffiliatesAccountedforUsingtheEquityMethod33NumberofEmployees13,440ContentsConsolidatedFinancialHighlights1Non-ConsolidatedFinancialHighlights1ToOurShareholders2TowardtheLaunchofSumitomoMitsuiBankingCorporation3Topics7ProgressReportonPlantowardSoundnessofManagement11FinancialReview12LoanStatus16FinancialSection21OverseasOffices32Directors,ExecutiveOfficersandAuditors33InformationforInvestors33Forfurtherinformation,pleasecontact:InvestorRelationsDepartmentPlanningDivisionTel:+81332303111Thismaterialcontainscertainforward-lookingstatements.Suchforward-lookingstatementsarenotguaranteesoffutureperformanceandinvolverisksanduncertainties,andactualresultsmaymateriallydifferfromthosecontainedintheforward-lookingstatementsasaresultofvariousfactors.Importantfactorsthatmightcausesuchamaterialdifferenceinclude,butarenotlimitedto,thoseeconomicconditionsreferredtointhismaterialasassumptions.Inaddition,thefollowingitemsareamongthefactorsthatcouldcauseactualresultstodiffermateriallyfromtheforward-lookingstatementsinthismaterial:businessconditionsinthebankingindustry,theregulatoryenviron-ment,newlegislation,competitionwithotherfinancialservicescompanies,changingtechnologyandevolvingbankingindustrystandardsandsimilarmatters.http://www.sakura.co.jp/bank/index-e.htmRatings(AsofDecember31,2000)Long-TermShort-TermMoody’sA3Prime-1S&PBBB+A–2FitchAF1R&IAA–a–1+Thisinterimfinancialreportwasprintedonrecycledpaper.1MillionsofSixMonthsEndedSeptember30,2000and1999,andMillionsofYenU.S.DollarsYearEndedMarch31,2000Sept.30,2000Sept.30,1999Mar.31,2000Sept.30,2000FortheTermTotalIncome¥884,783¥918,153¥2,157,102$8,192TotalExpenses799,283841,5782,030,9637,400IncomebeforeIncomeTaxesandMinorityInterests85,50076,574126,139791NetIncome31,30240,80362,581289AtTerm-EndTotalAssets50,713,08048,825,91548,495,608469,565LoansandBillsDiscounted33,330,30532,592,30232,333,211308,613Securities7,581,1106,612,6666,928,74670,195Deposits35,859,34934,301,31333,738,616332,031TotalStockholders’Equity2,183,7522,202,5502,208,55420,219CapitalRatio(%)12.30%12.43%12.53%12.30%YenU.S.DollarsPerShareofCommonStockNetIncome¥6.26¥8.63¥12.58$0.05TotalStockholders’Equity335.35338.30340.983.10Non-ConsolidatedFinancialHighlightsTheSakuraBank,LimitedMillionsofSixMonthsEndedSeptember30,2000and1999,andMillionsofYenU.S.DollarsYearEndedMarch31,2000Sept.30,2000Sept.30,1999Mar.31,2000Sept.30,2000FortheTermTotalIncome¥749,216¥817,025¥1,930,928$6,937TotalExpenses655,658762,7331,776,8586,070IncomebeforeIncomeTaxes93,55854,291154,069866NetIncome51,93933,07057,117480AtTerm-EndTotalAssets46,877,87347,141,47946,559,485434,054LoansandBillsDiscounted31,232,50232,143,36431,939,952289,189Securities7,268,1996,576,8416,911,60267,298Deposits33,330,14834,005,76733,342,655308,612TotalStockholders’Equity2,28...