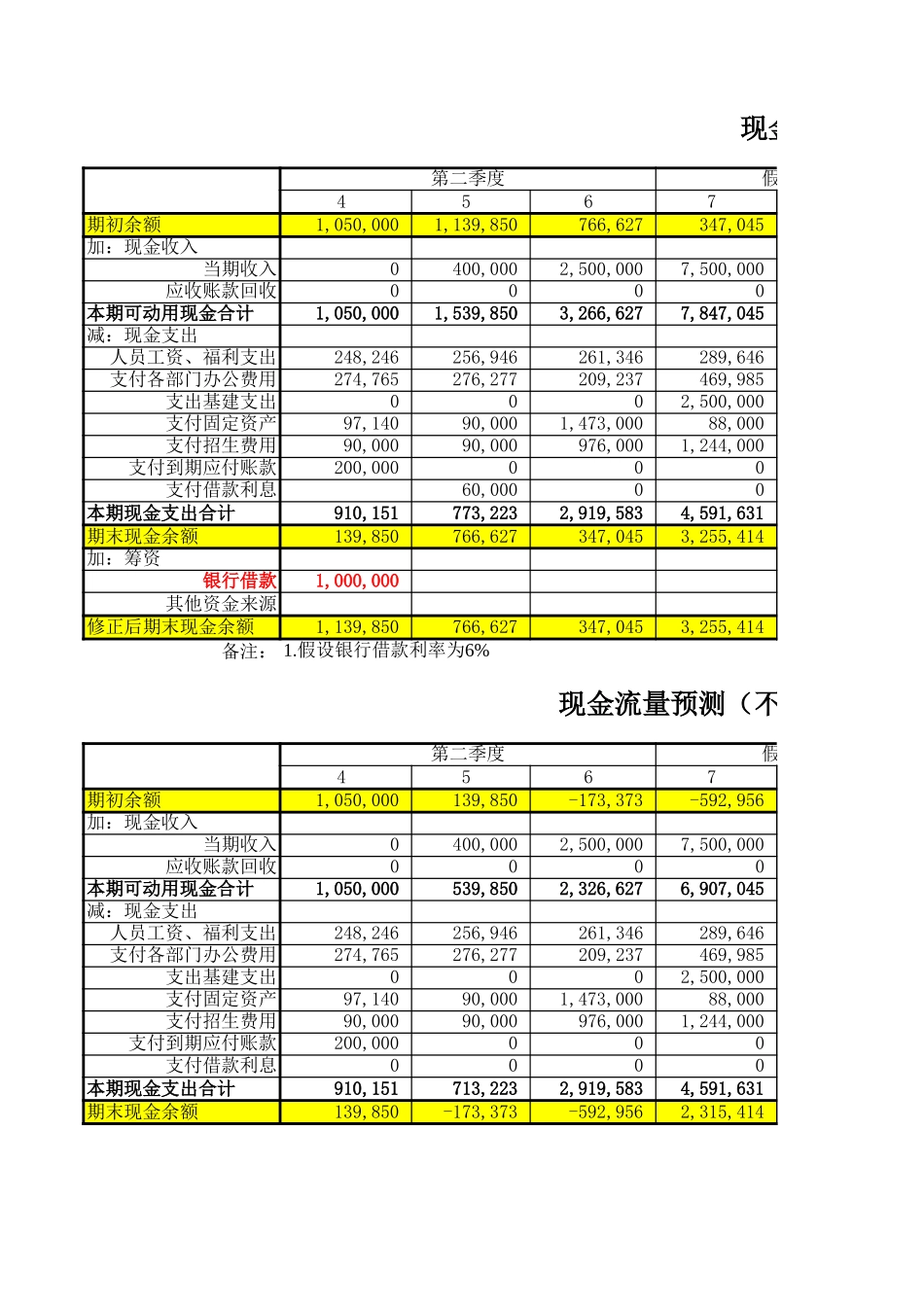

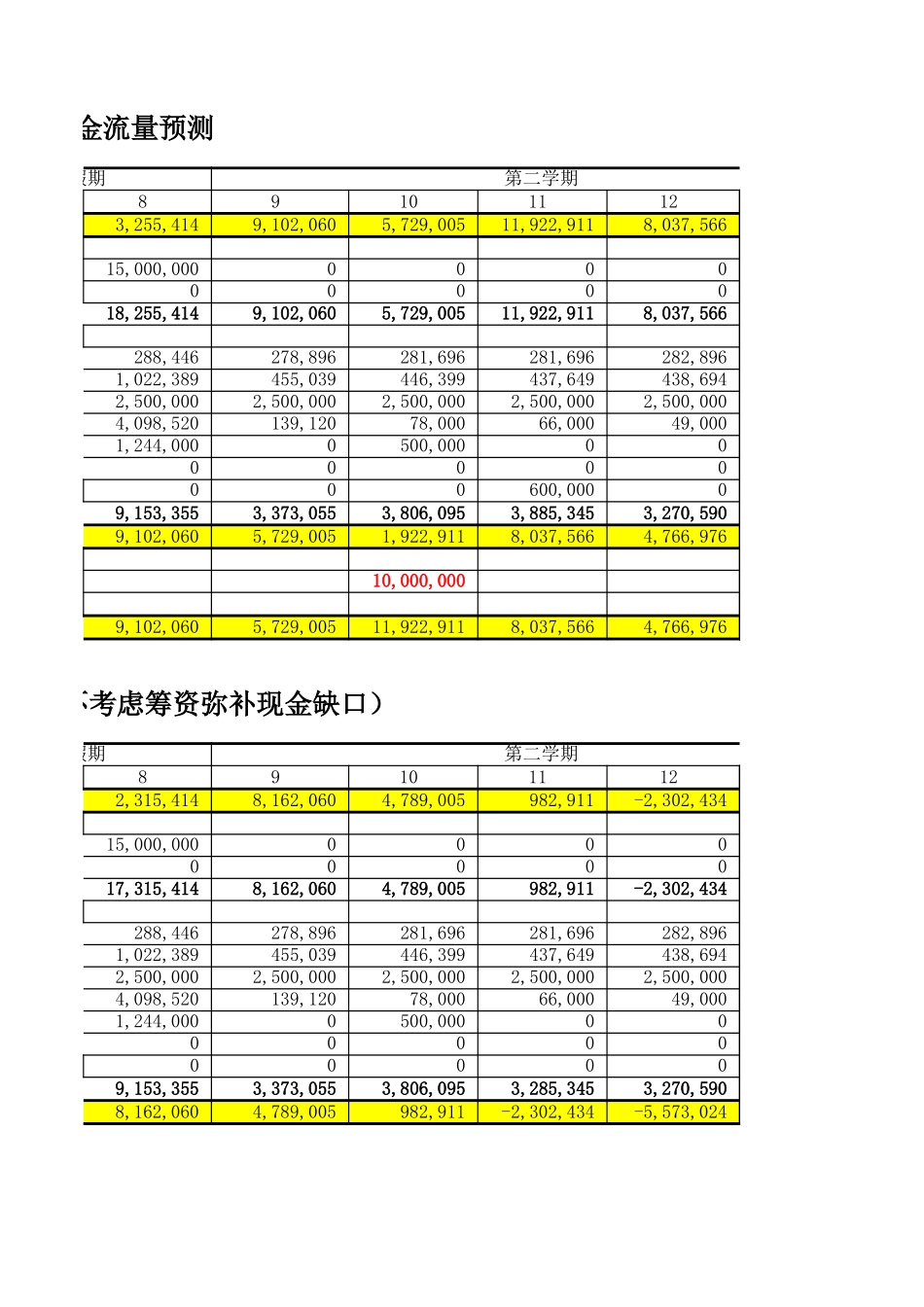

现金流量预测第二季度假期4567期初余额1,050,0001,139,850766,627347,045加:现金收入当期收入0400,0002,500,0007,500,000应收账款回收0000本期可动用现金合计1,050,0001,539,8503,266,6277,847,045减:现金支出人员工资、福利支出248,246256,946261,346289,646支付各部门办公费用274,765276,277209,237469,985支出基建支出0002,500,000支付固定资产97,14090,0001,473,00088,000支付招生费用90,00090,000976,0001,244,000支付到期应付账款200,000000支付借款利息60,00000本期现金支出合计910,151773,2232,919,5834,591,631期末现金余额139,850766,627347,0453,255,414加:筹资银行借款1,000,000其他资金来源修正后期末现金余额1,139,850766,627347,0453,255,414备注:现金流量预测(不考虑筹资弥补现金缺口)第二季度假期4567期初余额1,050,000139,850-173,373-592,956加:现金收入当期收入0400,0002,500,0007,500,000应收账款回收0000本期可动用现金合计1,050,000539,8502,326,6276,907,045减:现金支出人员工资、福利支出248,246256,946261,346289,646支付各部门办公费用274,765276,277209,237469,985支出基建支出0002,500,000支付固定资产97,14090,0001,473,00088,000支付招生费用90,00090,000976,0001,244,000支付到期应付账款200,000000支付借款利息0000本期现金支出合计910,151713,2232,919,5834,591,631期末现金余额139,850-173,373-592,9562,315,4141.假设银行借款利率为6%现金流量预测假期第二学期891011123,255,4149,102,0605,729,00511,922,9118,037,56615,000,00000000000018,255,4149,102,0605,729,00511,922,9118,037,566288,446278,896281,696281,696282,8961,022,389455,039446,399437,649438,6942,500,0002,500,0002,500,0002,500,0002,500,0004,098,520139,12078,00066,00049,0001,244,0000500,0000000000000600,00009,153,3553,373,0553,806,0953,885,3453,270,5909,102,0605,729,0051,922,9118,037,5664,766,97610,000,0009,102,0605,729,00511,922,9118,037,5664,766,976现金流量预测(不考虑筹资弥补现金缺口)假期第二学期891011122,315,4148,162,0604,789,005982,911-2,302,43415,000,00000000000017,315,4148,162,0604,789,005982,911-2,302,434288,446278,896281,696281,696282,8961,022,389455,039446,399437,649438,6942,500,0002,500,0002,500,0002,500,0002,500,0004,098,520139,12078,00066,00049,0001,244,0000500,0000000000000009,153,3553,373,0553,806,0953,285,3453,270,5908,162,0604,789,005982,911-2,302,434-5,573,024现金流量预测第二学期14,766,976004,766,976290,996508,9292,500,00079,2000003,379,1251,387,8511,387,851现金流量预测(不考虑筹资弥补现金缺口)第二学期1-5,573,02400-5,573,024290,996508,9292,500,00079,2000003,379,125-8,952,149利润预测第二季度假期4567事业收入以前年度学费收入0400,00000当年学费收入00583,3331,750,000其他收入事业收入合计0400,000583,3331,750,000事业支出支付人员工资福利费用248,246256,946261,346289,646支付各部门开支274,765276,277209,237469,985以前年度固定资产折旧118,750118,750118,750118,750当年固定资产折旧07691,48213,143支付招生费用90,00090,000976,0001,244,000支付借款利息60,00000其他支出事业支出合计731,761802,7421,566,8142,135,523事业结余-731,761-402,742-983,481-385,523备注:1.当年学费收入为当年招生收入总额扣除教育后备金后,并根据教学年限进行递延后的收入2.假设当年招生收入中有30%是教育后备金,并且收取的学费服务期限是3.假设以前年度固定资产总额3000万,5%残值,20年折旧;当年购入固定资产残值利润预测假期第二学期8910111210000003,500,000000003,500,00000000288,446278,896281,696281,696282,896290,9961,022,389455,039446,399437,649438,694508,929118,750118,750118,750118,750118,750118,75013,83946,28647,38748,00548,52748,9151,244,0000500,000000000600,000002,687,424898,9711,394,2321,486,099888,868967,590812,576-898,971-1,...