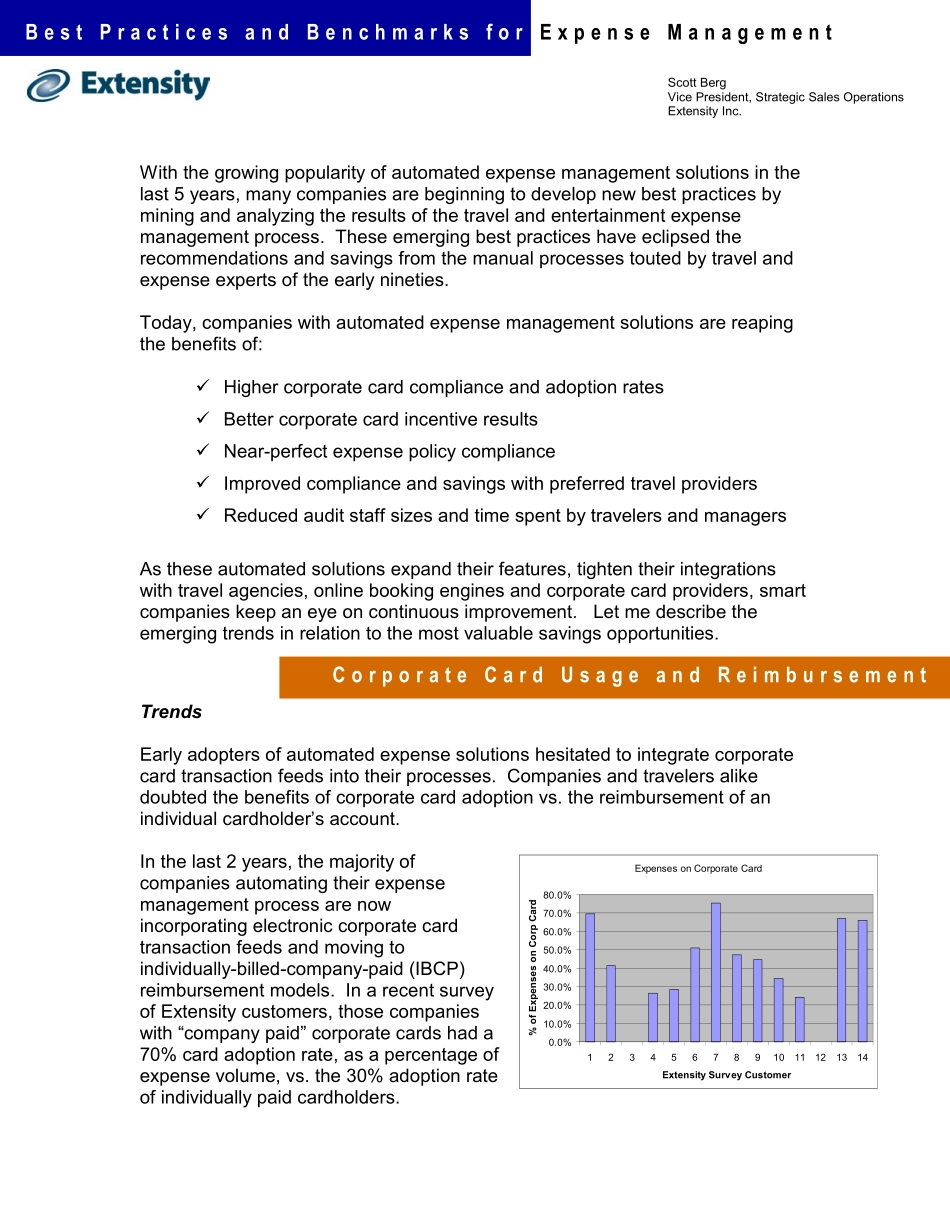

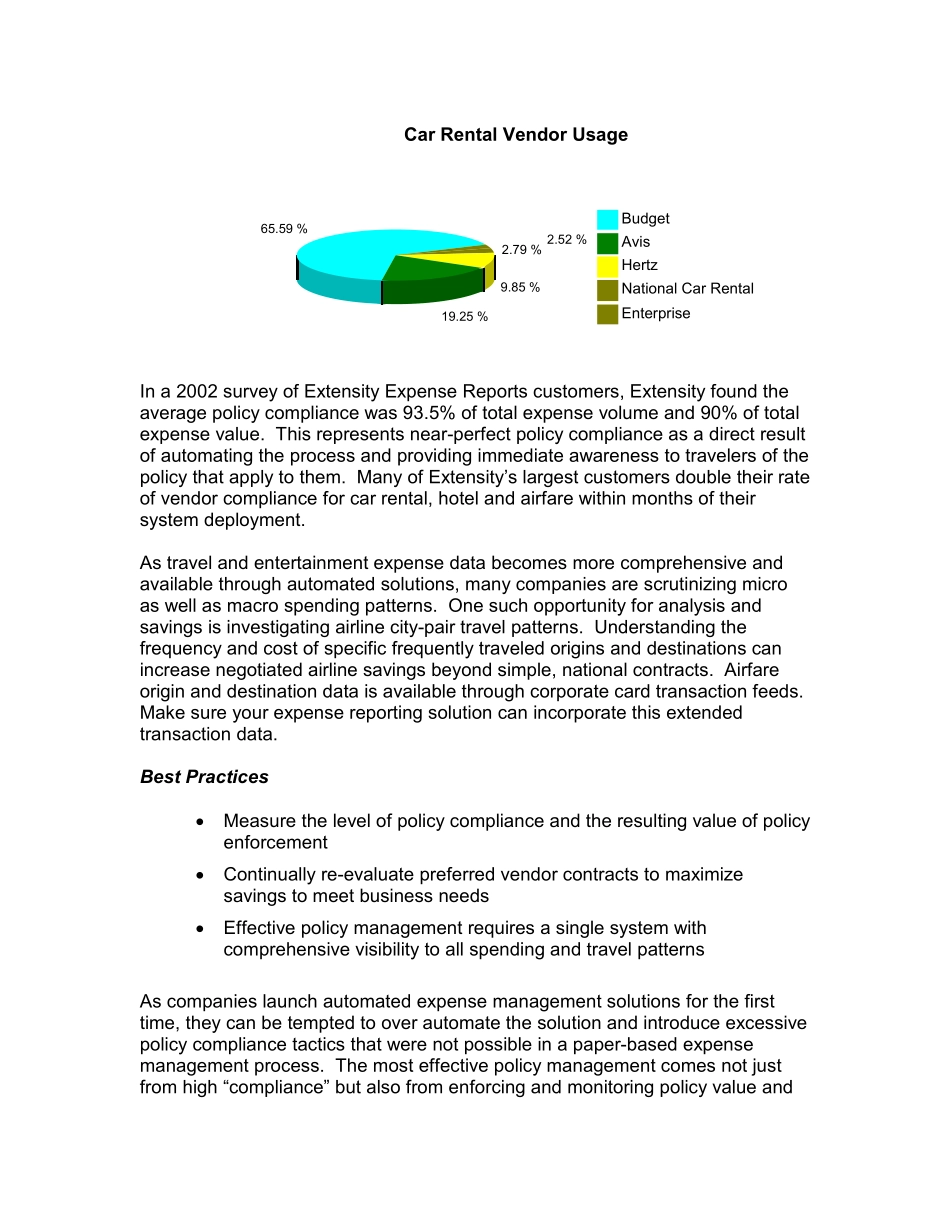

BestPracticesandBenchmarksforExpenseManagementScottBergVicePresiden,StrategicSalesOperationstExtensityInc.Withthegrowingpopularityofautomatedexpensemanagementsolutionsinthelast5years,manycompaniesarebeginningtodevelopnewbestpracticesbyminingandanalyzingtheresultsofthetravelandentertainmentexpensemanagementprocess.Theseemergingbestpracticeshaveeclipsedtherecommendationsandsavingsfromthemanualprocessestoutedbytravelandexpenseexpertsoftheearlynineties.Today,companieswithautomatedexpensemanagementsolutionsarereapingthebenefitsof:��Highercorporatecardcomplianceandadoptionrates��Bettercorporatecardincentiveresults��Near-perfectexpensepolicycompliance��Improvedcomplianceandsavingswithpreferredtravelproviders��ReducedauditstaffsizesandtimespentbytravelersandmanagersAstheseautomatedsolutionsexpandtheirfeatures,tightentheirintegrationswithtravelagencies,onlinebookingenginesandcorporatecardproviders,smartcompanieskeepaneyeoncontinuousimprovement.Letmedescribetheemergingtrendsinrelationtothemostvaluablesavingsopportunities.CorporateCardUsageandReimbursementTrendsEarlyadoptersofautomatedexpensesolutionshesitatedtointegratecorporatecardtransactionfeedsintotheirprocesses.Companiesandtravelersalikedoubtedthebenefitsofcorporatecardadoptionvs.thereimbursementofanindividualcardholder’saccount.Inthelast2years,themajorityofcompaniesautomatingtheirexpensemanagementprocessarenowincorporatingelectroniccorporatecardtransactionfeedsandmovingtoindividually-billed-company-paid(IBCP)reimbursementmodels.InarecentsurveyofExtensitycustomers,thosecompanieswith“companypaid”corporatecardshada70%cardadoptionrate,asapercentageofexpensevolume,vs.the30%adoptionrateofindividuallypaidcardholders.ExpensesonCorporateCard0.0%10.0%20.0%30.0%40.0%50.0%60.0%70.0%80.0%1234567891011121314ExtensitySurveyCustomer%ofExpensesonCorpCardBestPractices��Encourageuseofthecorporatecardtominimizeout-of-pocketreimbursements��Managecorporatecardremittancetomaximizebankincentives,floatvalue,andminimizepenalties��ProvidecentralreimbursementforcardtransactionsandminimizeemployeereimbursementfrequencyandprocessingcostWhenacompanyencouragesitsemployeestoputalltravelexpensesonthecorporatecardandagreestopaythoseexpensesdirectly,uponapproval,theyeliminatetheemployee’sburdenforcarryingout-of-pocketexpenses.Travelandexpensemanagementpracticesthatmaximizetheuseofcentrallypaidcorporatecards,eliminatetheneedtorushreimbursementstoemployeesonadailybasis.Inreturn,thecorporationnowbenefitsfrommanagingthe“float”valueofoutstandingexpenseswiththecardprovider/bankandreducesitAccountsPayablecostsbyreducingthefrequencyofreimbursementcheckstoemployees.Today’sbest-practicecompanieshaveadoptedatwice-per-monthemployeereimbursementprocessandatightlymanaged,monthlyremittancetothecardprovider.Corporationscanonlymanagethismonthlyremittancetothecardproviderbyusingpowerfulanalytics.Theseanalytictoolsturntransactiondataintovaluableinformationaboutthecycletimefromthepoint-of-sale,totheoptimalreimbursementtothecardprovider.Optimizingthisremittancerequirescompaniestoconsidertheincentivesforquickandtimelypayment,minimizelatepaymentpenalties,andmaximizethefinancialvalueofthe“float”ofholdingexpensereimbursementsuntiltheoptimalbankduedate.PolicyComplianceandItsEffectonExpenseTrendsA1999studyoftravelandentertainmentmanagementbestpractices,byVisaan...