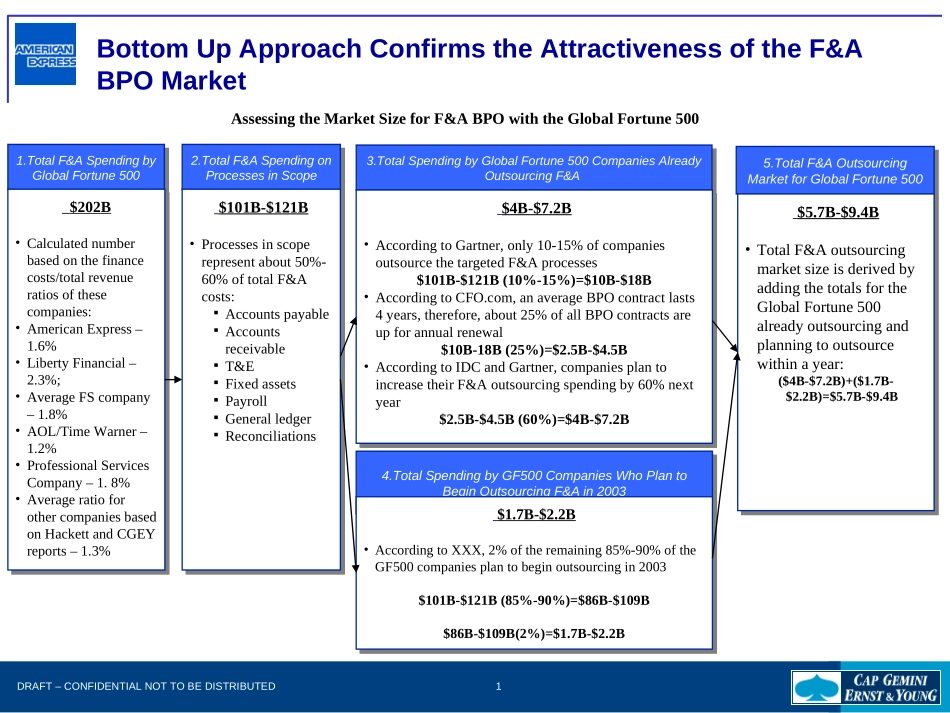

1DRAFT–CONFIDENTIALNOTTOBEDISTRIBUTEDBottomUpApproachConfirmstheAttractivenessoftheF&ABPOMarket3.TotalSpendingbyGlobalFortune500CompaniesAlreadyOutsourcingF&A3.TotalSpendingbyGlobalFortune500CompaniesAlreadyOutsourcingF&A$4B-$7.2B•AccordingtoGartner,only10-15%ofcompaniesoutsourcethetargetedF&Aprocesses$101B-$121B(10%-15%)=$10B-$18B•AccordingtoCFO.com,anaverageBPOcontractlasts4years,therefore,about25%ofallBPOcontractsareupforannualrenewal$10B-18B(25%)=$2.5B-$4.5B•AccordingtoIDCandGartner,companiesplantoincreasetheirF&Aoutsourcingspendingby60%nextyear$2.5B-$4.5B(60%)=$4B-$7.2B$4B-$7.2B•AccordingtoGartner,only10-15%ofcompaniesoutsourcethetargetedF&Aprocesses$101B-$121B(10%-15%)=$10B-$18B•AccordingtoCFO.com,anaverageBPOcontractlasts4years,therefore,about25%ofallBPOcontractsareupforannualrenewal$10B-18B(25%)=$2.5B-$4.5B•AccordingtoIDCandGartner,companiesplantoincreasetheirF&Aoutsourcingspendingby60%nextyear$2.5B-$4.5B(60%)=$4B-$7.2B4.TotalSpendingbyGF500CompaniesWhoPlantoBeginOutsourcingF&Ain20034.TotalSpendingbyGF500CompaniesWhoPlantoBeginOutsourcingF&Ain2003$1.7B-$2.2B•AccordingtoXXX,2%oftheremaining85%-90%oftheGF500companiesplantobeginoutsourcingin2003$101B-$121B(85%-90%)=$86B-$109B$86B-$109B(2%)=$1.7B-$2.2B$1.7B-$2.2B•AccordingtoXXX,2%oftheremaining85%-90%oftheGF500companiesplantobeginoutsourcingin2003$101B-$121B(85%-90%)=$86B-$109B$86B-$109B(2%)=$1.7B-$2.2B5.TotalF&AOutsourcingMarketforGlobalFortune5005.TotalF&AOutsourcingMarketforGlobalFortune500$5.7B-$9.4B•TotalF&AoutsourcingmarketsizeisderivedbyaddingthetotalsfortheGlobalFortune500alreadyoutsourcingandplanningtooutsourcewithinayear:($4B-$7.2B)+($1.7B-$2.2B)=$5.7B-$9.4B$5.7B-$9.4B•TotalF&AoutsourcingmarketsizeisderivedbyaddingthetotalsfortheGlobalFortune500alreadyoutsourcingandplanningtooutsourcewithinayear:($4B-$7.2B)+($1.7B-$2.2B)=$5.7B-$9.4B1.TotalF&ASpendingbyGlobalFortune5001.TotalF&ASpendingbyGlobalFortune500$202B•Calculatednumberbasedonthefinancecosts/totalrevenueratiosofthesecompanies:•AmericanExpress–1.6%•LibertyFinancial–2.3%;•AverageFScompany–1.8%•AOL/TimeWarner–1.2%•ProfessionalServicesCompany–1.8%•AverageratioforothercompaniesbasedonHackettandCGEYreports–1.3%$202B•Calculatednumberbasedonthefinancecosts/totalrevenueratiosofthesecompanies:•AmericanExpress–1.6%•LibertyFinancial–2.3%;•AverageFScompany–1.8%•AOL/TimeWarner–1.2%•ProfessionalServicesCompany–1.8%•AverageratioforothercompaniesbasedonHackettandCGEYreports–1.3%2.TotalF&ASpendingonProcessesinScope2.TotalF&ASpendingonProcessesinScope$101B-$121B•Processesinscoperepresentabout50%-60%oftotalF&Acosts:AccountspayableAccountsreceivableT&EFixedassetsPayrollGeneralledgerReconciliations$101B-$121B•Processesinscoperepresentabout50%-60%oftotalF&Acosts:AccountspayableAccountsreceivableT&EFixedassetsPayrollGeneralledgerReconciliationsAssessingtheMarketSizeforF&ABPOwiththeGlobalFortune500