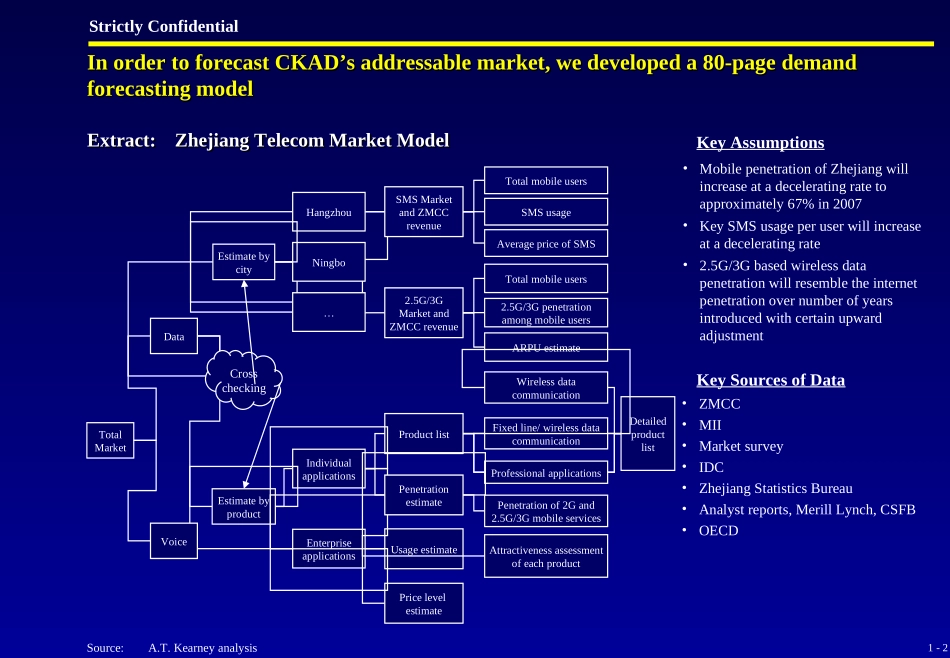

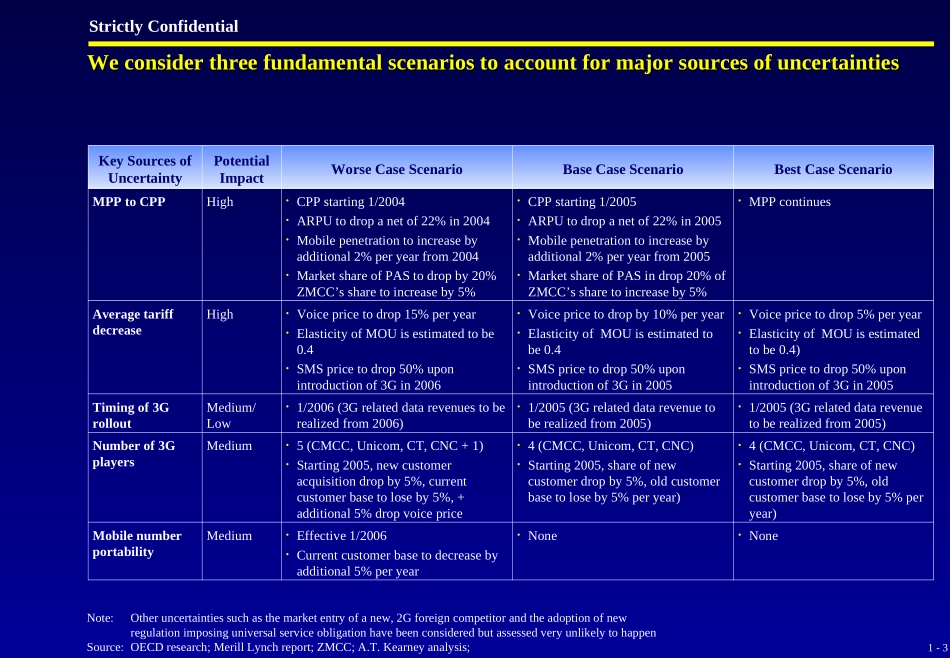

1-1StrictlyConfidential1.MarketForecast2.KeyTargetCustomers3.ProductStrategy4.StrategicPartnerships5.ChannelStrategy6.BrandStrategy7.OrganizationTableofContentsTableofContents1-2StrictlyConfidentialInordertoforecastCKAD’saddressablemarket,wedevelopeda80-pagedemandforecastingmodelInordertoforecastCKAD’saddressablemarket,wedevelopeda80-pagedemandforecastingmodelKeyAssumptions•MobilepenetrationofZhejiangwillincreaseatadeceleratingratetoapproximately67%in2007•KeySMSusageperuserwillincreaseatadeceleratingrate•2.5G/3GbasedwirelessdatapenetrationwillresembletheinternetpenetrationovernumberofyearsintroducedwithcertainupwardadjustmentKeySourcesofDataSource:A.T.KearneyanalysisExtract:ZhejiangTelecomMarketModelExtract:ZhejiangTelecomMarketModel•ZMCC•MII•Marketsurvey•IDC•ZhejiangStatisticsBureau•Analystreports,MerillLynch,CSFB•OECDDataEstimatebycityEstimatebyproduct2.5G/3GMarketandZMCCrevenueIndividualapplicationsEnterpriseapplicationsProductlistUsageestimateProfessionalapplicationsDetailedproductlistSMSMarketandZMCCrevenueTotalmobileusersARPUestimateTotalmobileusersSMSusageAveragepriceofSMS2.5G/3GpenetrationamongmobileusersHangzhouNingbo…PenetrationestimatePricelevelestimateFixedline/wirelessdatacommunicationWirelessdatacommunicationPenetrationof2Gand2.5G/3GmobileservicesAttractivenessassessmentofeachproductTotalMarketVoiceCrosschecking1-3StrictlyConfidentialWeconsiderthreefundamentalscenariostoaccountformajorsourcesofuncertaintiesWeconsiderthreefundamentalscenariostoaccountformajorsourcesofuncertaintiesKeySourcesofUncertaintyPotentialImpactWorseCaseScenarioBaseCaseScenarioBestCaseScenarioMPPtoCPPHigh•CPPstarting1/2004•ARPUtodropanetof22%in2004•Mobilepenetrationtoincreasebyadditional2%peryearfrom2004•MarketshareofPAStodropby20%ZMCC’ssharetoincreaseby5%•CPPstarting1/2005•ARPUtodropanetof22%in2005•Mobilepenetrationtoincreasebyadditional2%peryearfrom2005•MarketshareofPASindrop20%ofZMCC’ssharetoincreaseby5%•MPPcontinuesAveragetariffdecreaseHigh•Voicepricetodrop15%peryear•ElasticityofMOUisestimatedtobe0.4•SMSpricetodrop50%uponintroductionof3Gin2006•Voicepricetodropby10%peryear•ElasticityofMOUisestimatedtobe0.4•SMSpricetodrop50%uponintroductionof3Gin2005•Voicepricetodrop5%peryear•ElasticityofMOUisestimatedtobe0.4)•SMSpricetodrop50%uponintroductionof3Gin2005Timingof3GrolloutMedium/Low•1/2006(3Grelateddatarevenuestoberealizedfrom2006)•1/2005(3Grelateddatarevenuetoberealizedfrom2005)•1/2005(3Grelateddatarevenuetoberealizedfrom2005)Numberof3GplayersMedium•5(CMCC,Unicom,CT,CNC+1)•Starting2005,newcustomeracquisitiondropby5%,currentcustomerbasetoloseby5%,+additional5%dropvoiceprice•4(CMCC,Unicom,CT,CNC)•Starting2005,shareofnewcustomerdropby5%,oldcustomerbasetoloseby5%peryear)•4(CMCC,Unicom,CT,CNC)•Starting2005,shareofnewcustomerdropby5%,oldcustomerbasetoloseby5%peryear)MobilenumberportabilityMedium•Effective1/2006•Currentcustomerbasetodecreasebyadditional5%peryear•None•NoneNote:Otheruncertaintiessuchasthemarketentryofanew,2GforeigncompetitorandtheadoptionofnewregulationimposinguniversalserviceobligationhavebeenconsideredbutassessedveryunlikelytohappenSource:OECDresearch;MerillLynchreport;ZMCC;A.T.Kearneyanalysis;1-4StrictlyConfidential19.412.914.310.610.418.813.216.112.310.723.213.011.015.82003200420052006200711.4Dependingonscenarios,CKAD’saddress...