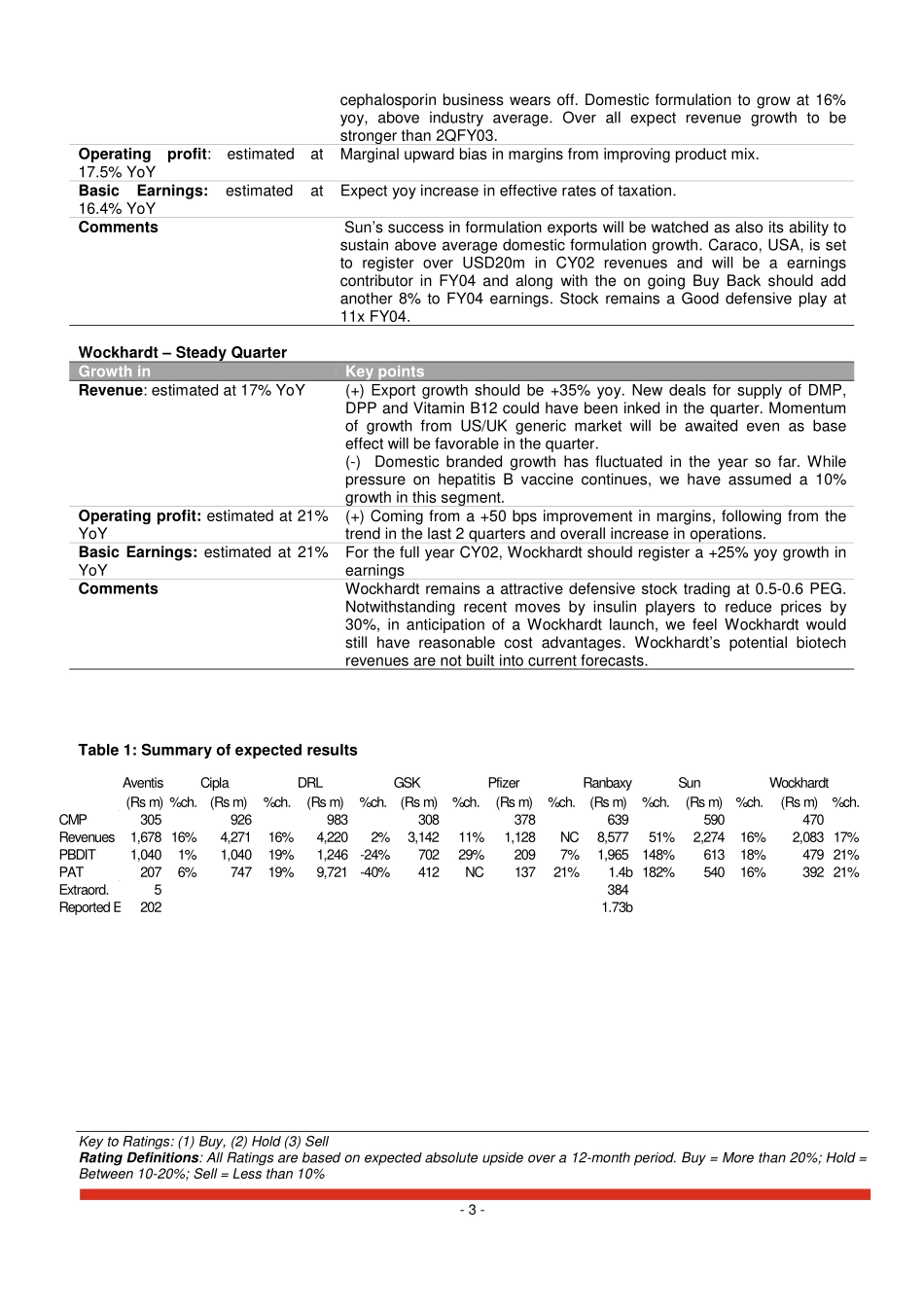

ThisdocumenthasbeenpreparedbyInvestsmartIndiaLtd.(theCompany)andisbeingdistributedinIndiabytheCompany,aregisteredbroker-dealer.Theinformationandopinionscontainedinthedocumenthavebeencompiledfromsourcesbelievedtobereliable.Thecompanydoesnotwarrantitsaccuracy,completenessandcorrectness.Thisdocumentisnot,andshouldnotbeconstruedas,anoffertosellorsolicitationtobuyanysecurities.Thisdocumentmaynotbereproduced,distributedorpublished,inwholeorinpart,byanyrecipienthereofforanypurposewithoutpriorpermissionfromtheCompany.©2003InvestsmartIndiaLtd.TheCompanyandtheanalyst(s),includinghisdependantfamilymembers,doesnothaveanyinterestinthesecuritiesrecommendedabove.Forfurtherinformationpleasecall:Research91-22-26533333Extn:3220Dealing:91-22-26533114-17AnIL&FSinitiativePreviewfortheQuarterendingDecember2002SECTOR:PHARMACEUTICALJanuary13,2003GauravMisra912226593212gaurav.misra@investsmartindia.comAventis–WeaknessincomparablemarginsYoYGrowthinKeypointsRevenue:estimatedat16%YoYExportsandRPRrangeshouldpullupgrowth,whichotherwisewillcontinuetobedrivenbyAventis’sstrategicbrandsOperatingprofit:toremainflat(-)Expecta250bpsyoydeclineinoperatingmargins.Marginstobecomparablewith2&3QCY02.ContinuedpressurefromincreaseinRMC/saleonaccountofimportdutyandforexmovement.BasicEarnings:estimatedat6.1%YoY4QwillconcludeaflatCY02andaconsolidationofoperations,especiallyoperatingmargins.CommentsAtCMPtradesat9xCY03E.AgoodvaluebuyconsideringAventis’sproductintroductionstrategy.Expectrecentweaknessinoperationstogetoverby1QCY03.Cipla–IntroductionofCFCfreeMDIawaitedGrowthinKeypointsRevenue:estimatedat17%YoY(+)Exportgrowthat25%todrivetopline.Growthwillcomefromarelativelyhighbasenumber(whichwouldhaveincludedsuppliesofomeprazole)andappearschallenging.1or2unknownmajorproductsuppliescouldspikegrowth.(+)LTAPIexportoutlookremainsstrongwithrecenttieupwithUSgenericfirm-Watson,forsupplyof10drugs.Earlier,CiplahadtiedupwithIvaxforsupplyof7APIs.(+)Domesticgrowthat12.5%yoy,inlinewiththerecenttrendrate.Operatingprofit:estimatedat+19%YoY(+)Whilemarginsin3Qhavetendedtobelowerthaninthe1H,weexpectanupwardbiasyoycomingfromanimprovingproductmix.BasicEarnings:estimatedat19.3%YoYDrivenfromsteadyoperations.BuiltinmarginalyoydeclineineffectivetaxratesonaccountofthenewGoafacility.Taxeffectcouldbestronger.CommentsCFCfreeMDIsalestoGermanyyettostart.Europeanentry,willbedriverforoutperformance.DrReddy’s–ComparablegrowthshouldbestrongYoYGrowthinKeypointsRevenue:estimatedat2.4%YoY(standaloneIndianGAAP)(+)Exexclusivefluoxetinesales,weexpectDRLtoregisterastrong+35%growthinrevenues.ThiswillbedrivenbyenhancedUSgenericoperationsoverasmallbaseyoyandpossiblystrongAPIexports.Operatingprofit:estimatedat-24%YoY(+)Weexpectthehealthymarginsof2Qtosustainin3Q,thoughyoyreportedmarginswilldeclineby1000bpsbecauseofexclusivefluoxetinesalesin3QFY02.BasicEarnings:estimatedatBesidesfluoxetine,3QFY02,alsohadtaxcreditsinthequarter.-2--40%YoYCommentsThebaseeffectoffluoxetinesales,willpulldownreportednumbers.However,guidanceonamlodipinecasewillbelookedforwardtooaswellasanyotherparaIVlitigations/update.GSK–RestructuringbenefitsshouldsustainwhileassetsaleprocessisunderwayYoYGrowthinKeypointsRevenue:estimatedat11%YoYWeexpectapickupinyoygrowthasbasenumbersof4QCY01werelowandalsofromthe4%growthin3QCY02.TherecouldbeapullbackeffectofGSKsnonpharmabusinesswhiledomesticpharmash...