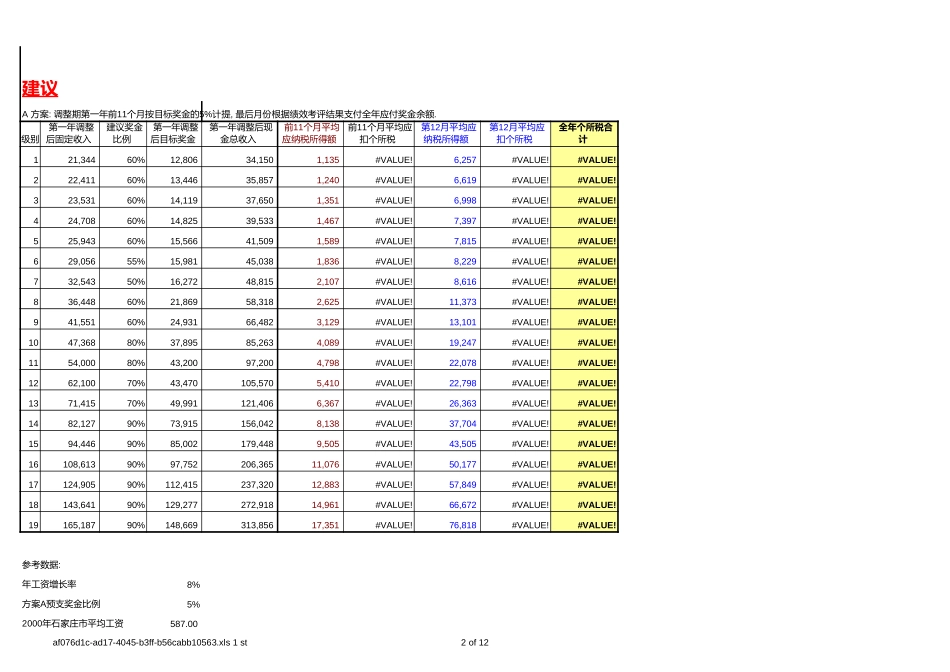

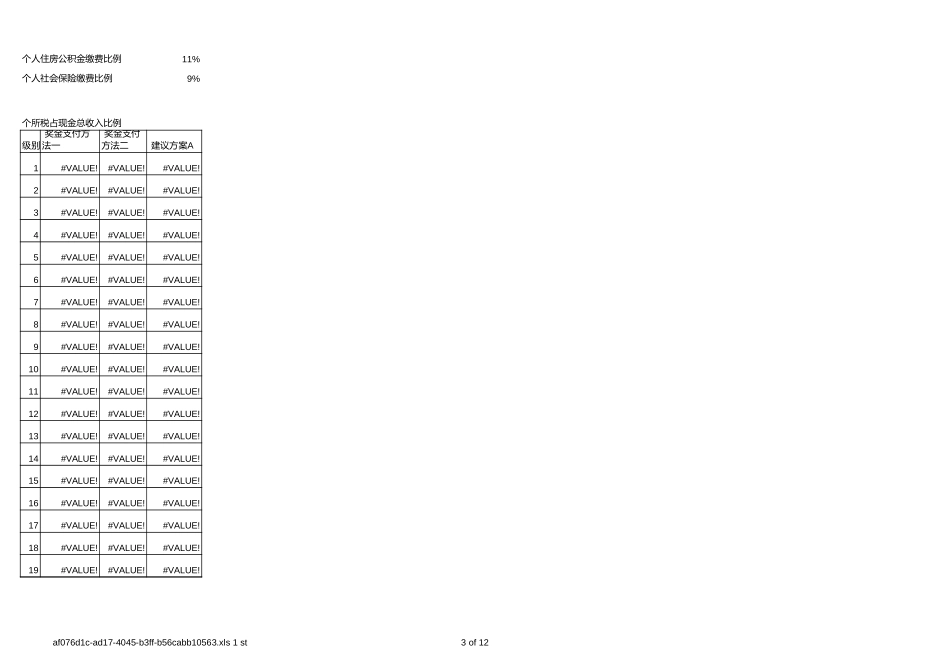

af076d1c-ad17-4045-b3ff-b56cabb10563.xls1st1of12方法比较级别个所税差异121,34460%12,80634,150494#VALUE!13,301#VALUE!#VALUE!1,562#VALUE!#VALUE!#VALUE!222,41160%13,44635,857568#VALUE!14,014#VALUE!#VALUE!1,688#VALUE!#VALUE!#VALUE!323,53160%14,11937,650645#VALUE!14,763#VALUE!#VALUE!1,821#VALUE!#VALUE!#VALUE!424,70860%14,82539,533725#VALUE!15,550#VALUE!#VALUE!1,961#VALUE!#VALUE!#VALUE!525,94360%15,56641,509810#VALUE!16,376#VALUE!#VALUE!2,107#VALUE!#VALUE!#VALUE!629,05655%15,98145,0381,037#VALUE!17,018#VALUE!#VALUE!2,369#VALUE!#VALUE!#VALUE!732,54350%16,27248,8151,293#VALUE!17,565#VALUE!#VALUE!2,649#VALUE!#VALUE!#VALUE!836,44860%21,86958,3181,532#VALUE!23,401#VALUE!#VALUE!3,354#VALUE!#VALUE!#VALUE!941,55160%24,93166,4821,882#VALUE!26,813#VALUE!#VALUE!3,960#VALUE!#VALUE!#VALUE!1047,36880%37,89585,2632,195#VALUE!40,089#VALUE!#VALUE!5,353#VALUE!#VALUE!#VALUE!1154,00080%43,20097,2002,638#VALUE!45,838#VALUE!#VALUE!6,238#VALUE!#VALUE!#VALUE!1262,10070%43,470105,5703,236#VALUE!46,706#VALUE!#VALUE!6,859#VALUE!#VALUE!#VALUE!1371,41570%49,991121,4063,867#VALUE!53,858#VALUE!#VALUE!8,033#VALUE!#VALUE!#VALUE!1482,12790%73,915156,0424,442#VALUE!78,357#VALUE!#VALUE!10,602#VALUE!#VALUE!#VALUE!1594,44690%85,002179,4485,254#VALUE!90,256#VALUE!#VALUE!12,338#VALUE!#VALUE!#VALUE!16108,61390%97,752206,3656,188#VALUE!103,940#VALUE!#VALUE!14,334#VALUE!#VALUE!#VALUE!17124,90590%112,415237,3207,262#VALUE!119,677#VALUE!#VALUE!16,630#VALUE!#VALUE!#VALUE!18143,64190%129,277272,9188,497#VALUE!137,774#VALUE!#VALUE!19,270#VALUE!#VALUE!#VALUE!19165,18790%148,669313,8569,917#VALUE!158,586#VALUE!#VALUE!22,306#VALUE!#VALUE!#VALUE!薪资结构-中移河北2002年调整数奖金支付方法一:财政年度结束后根据绩效考评一次性支付奖金支付方法二:把奖金平均预支至每个月第一年调整后固定收入中位值建议奖金比例第一年调整后目标奖金第一年调整后现金总收入中位值无奖金月份的应税所得额无奖金月个所税含奖金月份应税所得额含奖金月个所税全年个所税合计平均每月应税所得额平均每月个所税全年个所税合计af076d1c-ad17-4045-b3ff-b56cabb10563.xls1st2of12建议级别121,34460%12,80634,1501,135#VALUE!6,257#VALUE!#VALUE!222,41160%13,44635,8571,240#VALUE!6,619#VALUE!#VALUE!323,53160%14,11937,6501,351#VALUE!6,998#VALUE!#VALUE!424,70860%14,82539,5331,467#VALUE!7,397#VALUE!#VALUE!525,94360%15,56641,5091,589#VALUE!7,815#VALUE!#VALUE!629,05655%15,98145,0381,836#VALUE!8,229#VALUE!#VALUE!732,54350%16,27248,8152,107#VALUE!8,616#VALUE!#VALUE!836,44860%21,86958,3182,625#VALUE!11,373#VALUE!#VALUE!941,55160%24,93166,4823,129#VALUE!13,101#VALUE!#VALUE!1047,36880%37,89585,2634,089#VALUE!19,247#VALUE!#VALUE!1154,00080%43,20097,2004,798#VALUE!22,078#VALUE!#VALUE!1262,10070%43,470105,5705,410#VALUE!22,798#VALUE!#VALUE!1371,41570%49,991121,4066,367#VALUE!26,363#VALUE!#VALUE!1482,12790%73,915156,0428,138#VALUE!37,704#VALUE!#VALUE!1594,44690%85,002179,4489,505#VALUE!43,505#VALUE!#VALUE!16108,61390%97,752206,36511,076#VALUE!50,177#VALUE!#VALUE!17124,90590%112,415237,32012,883#VALUE!57,849#VALUE!#VALUE!18143,64190%129,277272,91814,961#VALUE!66,672#VALUE!#VALUE!19165,18790%148,669313,85617,351#VALUE!76,818#VALUE!#VALUE!年工资增长率8%5%587.00A方案:调整期第一年前11个月按目标奖金的5%计提,最后月份根据绩效考评结果支付全年应付奖金余额.第一年调整后固定收入建议奖金比例第一年调整后目标奖金第一年调整后现金总收入前11个月平均应纳税所得额前11个月平均应扣个所税第12月平均应纳税所得额第12月平均应扣个所税全年...