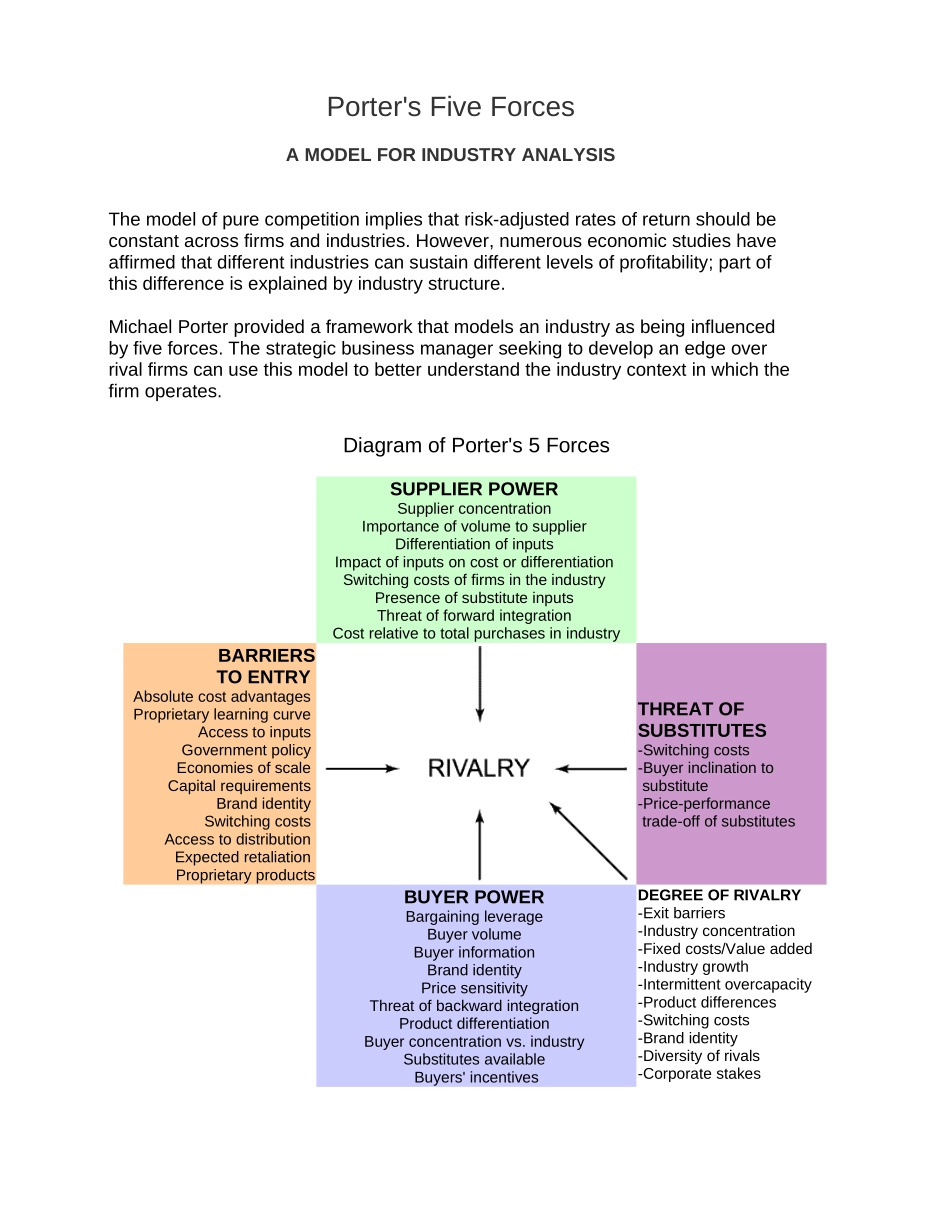

Porter'sFiveForcesAMODELFORINDUSTRYANALYSISThemodelofpurecompetitionimpliesthatrisk-adjustedratesofreturnshouldbeconstantacrossfirmsandindustries.However,numerouseconomicstudieshaveaffirmedthatdifferentindustriescansustaindifferentlevelsofprofitability;partofthisdifferenceisexplainedbyindustrystructure.MichaelPorterprovidedaframeworkthatmodelsanindustryasbeinginfluencedbyfiveforces.Thestrategicbusinessmanagerseekingtodevelopanedgeoverrivalfirmscanusethismodeltobetterunderstandtheindustrycontextinwhichthefirmoperates.DiagramofPorter's5ForcesSUPPLIERPOWERSupplierconcentrationImportanceofvolumetosupplierDifferentiationofinputsImpactofinputsoncostordifferentiationSwitchingcostsoffirmsintheindustryPresenceofsubstituteinputsThreatofforwardintegrationCostrelativetototalpurchasesinindustryBARRIERSTOENTRYAbsolutecostadvantagesProprietarylearningcurveAccesstoinputsGovernmentpolicyEconomiesofscaleCapitalrequirementsBrandidentitySwitchingcostsAccesstodistributionExpectedretaliationProprietaryproductsTHREATOFSUBSTITUTES-Switchingcosts-Buyerinclinationtosubstitute-Price-performancetrade-offofsubstitutesBUYERPOWERBargainingleverageBuyervolumeBuyerinformationBrandidentityPricesensitivityThreatofbackwardintegrationProductdifferentiationBuyerconcentrationvs.industrySubstitutesavailableBuyers'incentivesDEGREEOFRIVALRY-Exitbarriers-Industryconcentration-Fixedcosts/Valueadded-Industrygrowth-Intermittentovercapacity-Productdifferences-Switchingcosts-Brandidentity-Diversityofrivals-CorporatestakesI.RivalryInthetraditionaleconomicmodel,competitionamongrivalfirmsdrivesprofitstozero.Butcompetitionisnotperfectandfirmsarenotunsophisticatedpassivepricetakers.Rather,firmsstriveforacompetitiveadvantageovertheirrivals.Theintensityofrivalryamongfirmsvariesacrossindustries,andstrategicanalystsareinterestedinthesedifferences.Economistsmeasurerivalrybyindicatorsofindustryconcentration.TheConcentrationRatio(CR)isonesuchmeasure.TheBureauofCensusperiodicallyreportstheCRformajorStandardIndustrialClassifications(SIC's).TheCRindicatesthepercentofmarketshareheldbythefourlargestfirms(CR'sforthelargest8,25,and50firmsinanindustryalsoareavailable).Ahighconcentrationratioindicatesthatahighconcentrationofmarketshareisheldbythelargestfirms-theindustryisconcentrated.Withonlyafewfirmsholdingalargemarketshare,thecompetitivelandscapeislesscompetitive(closertoamonopoly).Alowconcentrationratioindicatesthattheindustryischaracterizedbymanyrivals,noneofwhichhasasignificantmarketshare.Thesefragmentedmarketsaresaidtobecompetitive.Theconcentrationratioisnottheonlyavailablemeasure;thetrendistodefineindustriesintermsthatconveymoreinformationthandistributionofmarketshare.Ifrivalryamongfirmsinanindustryislow,theindustryisconsideredtobedisciplined.Thisdisciplinemayresultfromtheindustry'shistoryofcompetition,theroleofaleadingfirm,orinformalcompliancewithagenerallyunderstoodcodeofconduct.Explicitcollusiongenerallyisillegalandnotanoption;inlow-rivalryindustriescompetitivemovesmustbeconstrainedinformally.However,amaverickfirmseekingacompetitiveadvantagecandisplacetheotherwisedisciplinedmarket.Whenarivalactsinawaythatelicitsacounter-responsebyotherfirms,rivalryintensifies.Theintensityofrivalrycommonlyisreferredtoasbeingcutthroat,intense,moderate,orweak,basedonthefirms'aggressivenessinattemptingtogainanadvantage.Inpursuinganadvantageoveritsr...