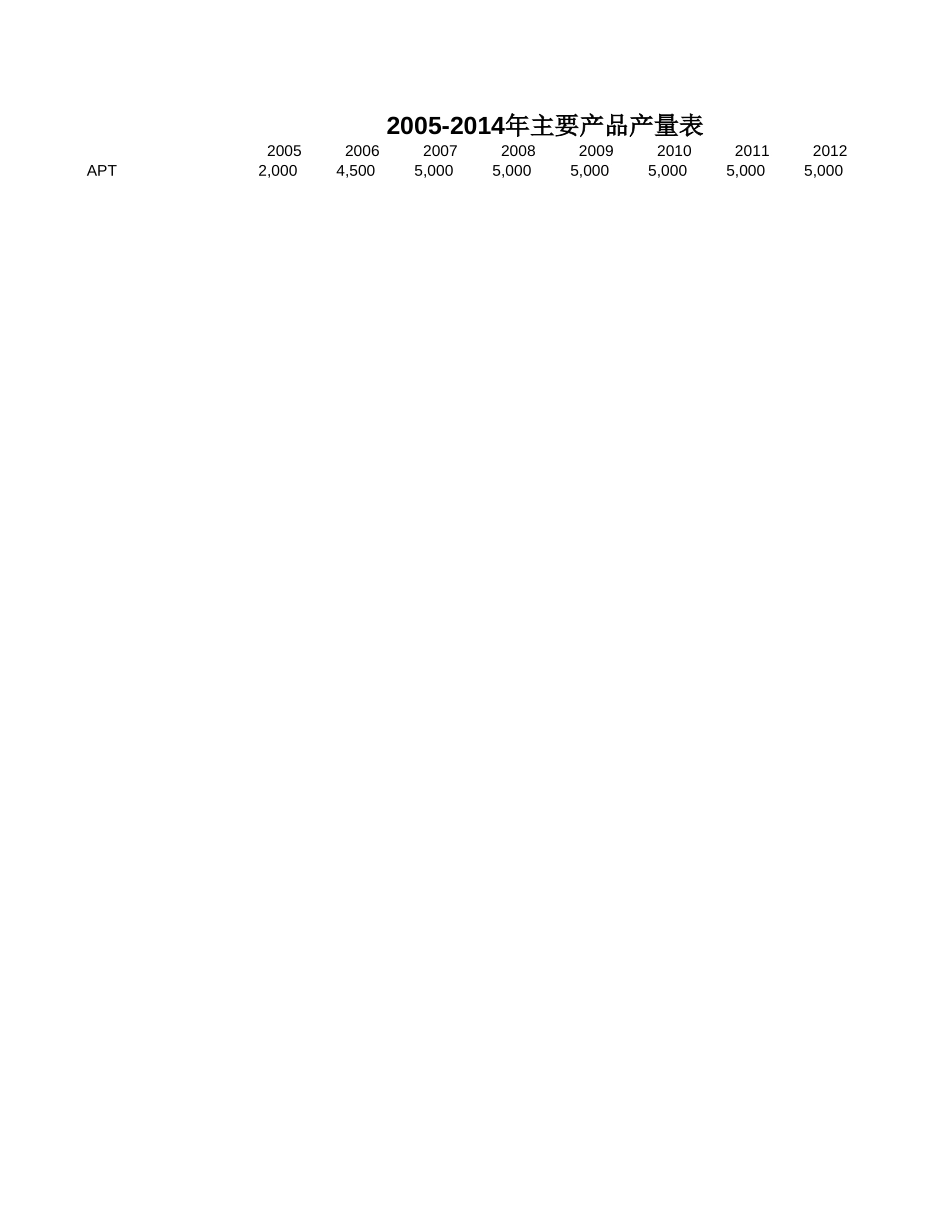

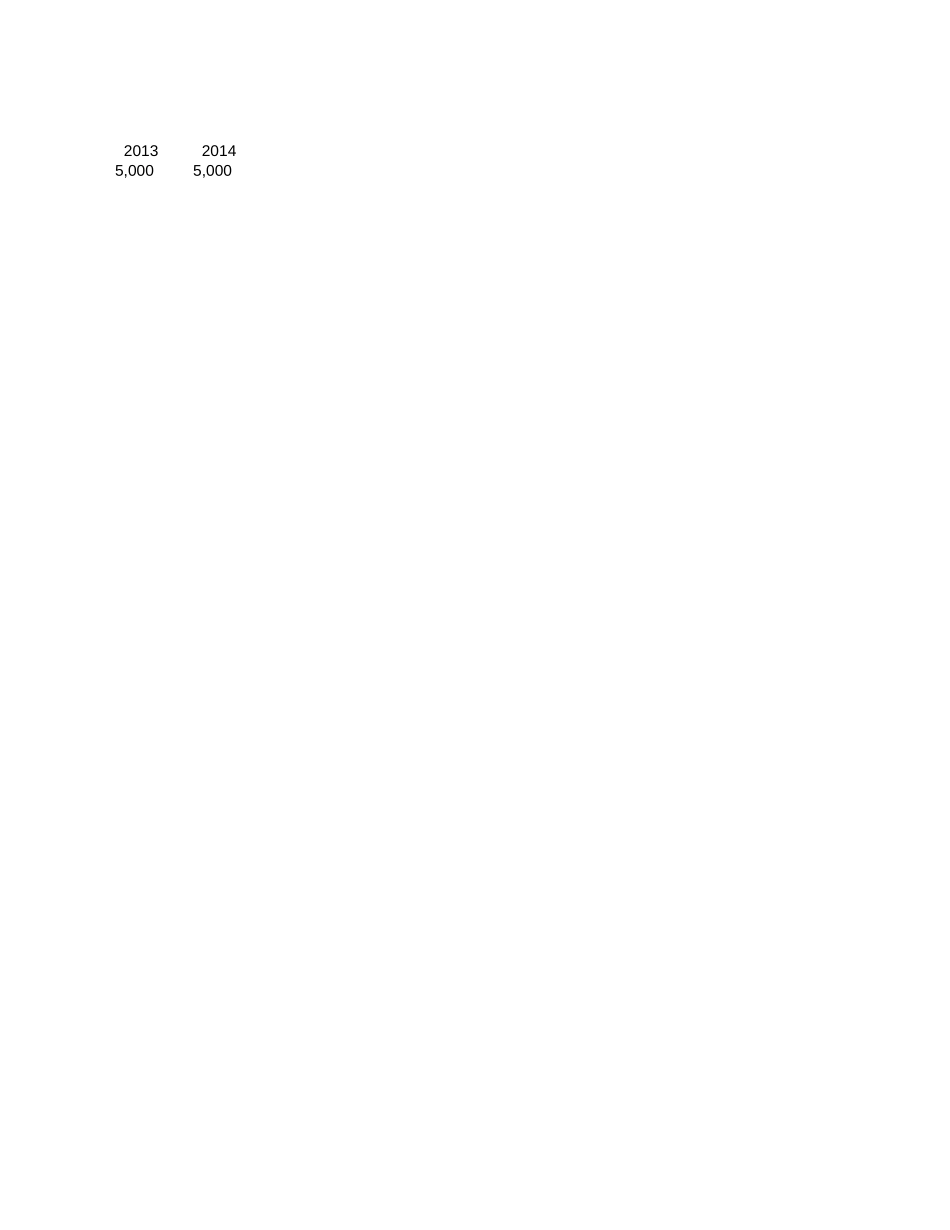

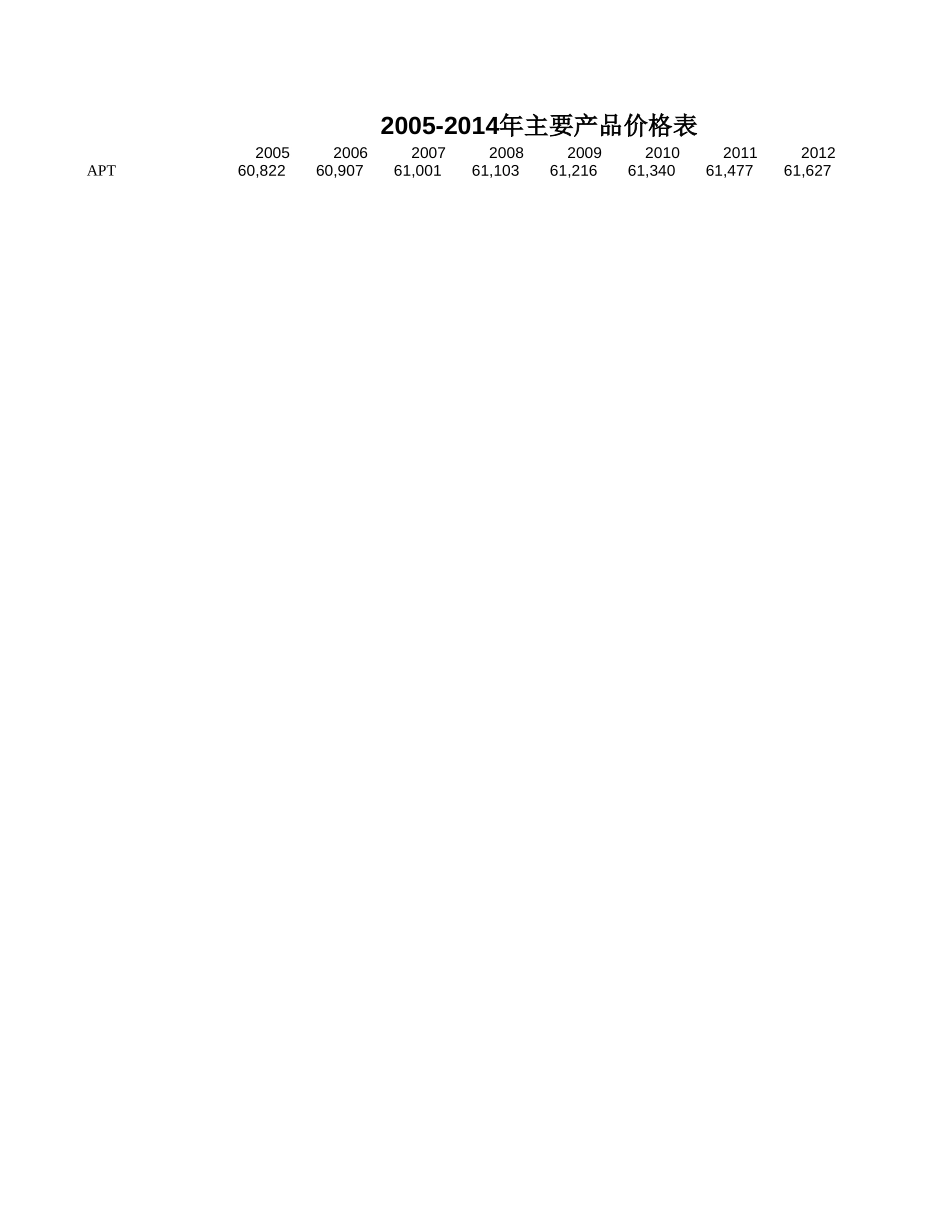

20052006200720082009201020112012APT2,0004,5005,0005,0005,0005,0005,0005,0002005-2014年主要产品产量表201320145,0005,00020052006200720082009201020112012APT60,82260,90761,00161,10361,21661,34061,47761,6272005-2014年主要产品价格表2013201461,79261,9742005200620072008200920102011一、主营业务收入10,39723,42626,06926,11226,16126,21426,272减:主营业务成本8,60819,35621,50021,51421,53021,54821,567主营业务税金及附加52117130131131131131二、主营业务利润1,7373,9534,4394,4684,5004,5354,574加:其他业务利润减:销售费用104234261261262262263管理费用149305313322331342353财务费用128324338339339339339三、营业利润1,3573,0893,5273,5463,5683,5923,619加:投资收益减:营业外支出四、利润总额1,3573,0893,5273,5463,5683,5923,619减:所得税4481,0201,1641,1701,1781,1851,194五、净利润9092,0702,3632,3762,3912,4072,424销售毛利率17.21%17.37%17.53%17.61%17.70%17.80%17.91%2005-2014年赣北钨业盈利预测表20122013201426,33626,40726,48521,58821,61121,6371321321324,6174,6644,7152632642653663803953403403413,6483,6793,7153,6483,6793,7151,2041,2141,2262,4442,4652,48918.03%18.16%18.30%17.76%年赣北钨业盈利预测表2005200620072008200920102011一、主营业务收入11,14125,09927,92827,97128,02028,07328,131减:主营业务成本9,35121,02823,35823,37323,38923,40623,425主营业务税金及附加56125140140140140141二、主营业务利润1,7343,9454,4304,4594,4914,5264,565加:其他业务利润减:销售费用111251279280280281281管理费用149305313322331342353财务费用130333348348349349349三、营业利润1,3443,0563,4893,5093,5313,5553,581加:投资收益减:营业外支出四、利润总额1,3443,0563,4893,5093,5313,5553,581减:所得税4441,0081,1521,1581,1651,1731,182五、净利润9002,0472,3382,3512,3662,3822,399销售毛利率16.06%16.22%16.36%16.44%16.53%16.62%16.73%赣北钨业盈利敏感性分析(上涨10%)20122013201428,19528,26628,34423,44723,47023,4961411411424,6084,6554,7062822832833663803953503503503,6103,6423,6773,6103,6423,6771,1911,2021,2142,4192,4402,4642,21116.84%16.97%17.10%16.59%10%)2005200620072008200920102011一、主营业务收入9,65321,75324,21024,25324,30224,35524,413减:主营业务成本7,86417,68319,64119,65619,67219,68919,709主营业务税金及附加48109121121122122122二、主营业务利润1,7413,9614,4474,4764,5094,5444,583加:其他业务利润减:销售费用97218242243243244244管理费用149305313322331342353财务费用126315328329329329330三、营业利润1,3703,1233,5643,5843,6053,6293,656加:投资收益减:营业外支出四、利润总额1,3703,1233,5643,5843,6053,6293,656减:所得税4521,0311,1761,1831,1901,1981,206五、净利润9182,0922,3882,4012,4162,4322,449销售毛利率18.53%18.71%18.87%18.96%19.05%19.16%19.27%赣北钨业盈利敏感性分析(下跌10%)20122013201424,47724,54824,62619,73019,75319,7791221231234,6254,6724,7242452452463663803953303303313,6853,7173,7523,6853,7173,7521,2161,2261,2382,4692,4902,5142,25719.40%19.53%19.68%19.12%10%)