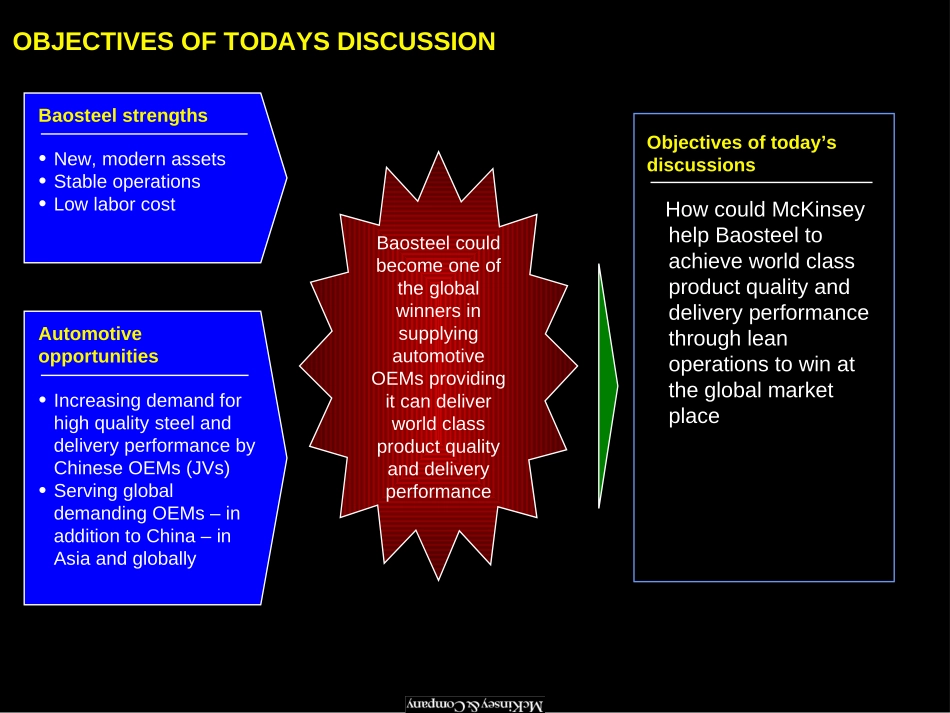

BS/011205/SH-WS(2000)CONFIDENTIALCreatingValueThroughCustomerDrivenLeanOperationsinSteelandMetalsIndustriesDecember,2001Thisreportissolelyfortheuseofclientpersonnel.Nopartofitmaybecirculated,quoted,orreproducedfordistributionoutsidetheclientorganizationwithoutpriorwrittenapprovalfromMcKinsey&Company.ThismaterialwasusedbyMcKinsey&Companyduringanoralpresentation;itisnotacompleterecordofthediscussion.BS/011205/SH-WS(2000)2OBJECTIVESOFTODAYSDISCUSSIONBaosteelstrengths•New,modernassets•Stableoperations•LowlaborcostAutomotiveopportunities•IncreasingdemandforhighqualitysteelanddeliveryperformancebyChineseOEMs(JVs)•ServingglobaldemandingOEMs–inadditiontoChina–inAsiaandgloballyBaosteelcouldbecomeoneoftheglobalwinnersinsupplyingautomotiveOEMsprovidingitcandeliverworldclassproductqualityanddeliveryperformanceObjectivesoftoday’sdiscussionsHowcouldMcKinseyhelpBaosteeltoachieveworldclassproductqualityanddeliveryperformancethroughleanoperationstowinattheglobalmarketplaceBS/011205/SH-WS(2000)3AGENDA¶Customerdrivenleancompaniescreatemorevaluealsoinsteelandothermetals¶Whatiscustomerdrivenleanoperationsinsteelandmetals¶McKinseyexperienceintransformingcompaniesintocustomerdrivenleanoperationsinsteel¶McKinseyexperienceinintroducingperformancebasedcompensationsystemstosupportthecompanytransformationinChina¶ProposednextstepsBS/011205/SH-WS(2000)4CUSTOMERDRIVENLEANOPERATIONSCREATEACOMPETITIVEADVANTAGEANDMOREVALUEALSOINSTEELANDMETALSValueofUSD100investedfor5years,October2001*Alusuisse,Pechiney,Alcan,KaiserAlu,andCapralSource:Datastream;McKinseyanalysisToyotaJapanAutomobileindexAlcoaAluminumcompetition*DowChemicalUSChemicalsindexLeanoperationscanbeimplementedinprocessindustriesEarlyadopterscangainacompetitiveadvantage103972201098757128102Steel&aluminumNucorUSSteelindexBS/011205/SH-WS(2000)5WITHLEANOPERATIONSALCOAHASOUTPERFORMEDCOMPETITORSFINANCIALLYaAPSimplementationbeganJanuary1997,butABSsavingswerenotclaimeduntil1998bAssumingnolossofcostsavingsovertimecReturnoncapitalemployedfortotalbusinessdIncludingAlusuissethatAlcanacquiredin2000,Alusuissenetincome1999wasUSD452millionSource:Annualreports;Datastream;DeutscheBank;pressclippings;teamanalysis817-54148410618d46039948519961997199819992000NetincomeUSDmillions482326372371578812515300150OtherNetincomeattributedtoAPSb8531,0541,484AlumaxsynergiesattributedtoAPS805a558352330325166AlcoaAlcanPechineyAluminumKaiserAluminum199619971998199920001996199719981999200019961997199819992000n/aReturnoncapitalemployed,2000Percent14.46.510.49.4cBS/011205/SH-WS(2000)6*Alcoa’squarterlynetincomeadjustedforspecialitemsSource:Alcoa’squarterlyreports;LondonMetalExchangeLEANOPERATIONSHAVEHELPEDALCOABREAKOUTOFTHEALUMINUMPRICECYCLEAlcoa’sperformancevs.aluminumprices,Q11982–Q120010.40.60.81.01.21.4AluminumspotpriceUSD/poundAdjustednetincome*USDmillions-100010020030040019901985198219952000InitiatedAlcoaProductionSystemBS/011205/SH-WS(2000)7FOLLOWINGITSPERFORMANCEIMPROVEMENT,ALCOA’SVALUATIONHASIMPROVED*ReynoldsmergerwasannouncedinAugust1999butrealizedinMay2000,sincethenAlcoahadmadesomeadditionalacquisitionswhichdidnotchangemarkettobookvalueorbookvaluesignificantlyuntilOct.2001Source:Alcoa’sannualreports;Datastream;pressclippingsPerformance:Market-to-bookratioSize:Bookvalueofcommonequity0.02.04.06.08.010.012.014.016.0MarketvalueUSDbillions,ratio(1996–2001)“AB...