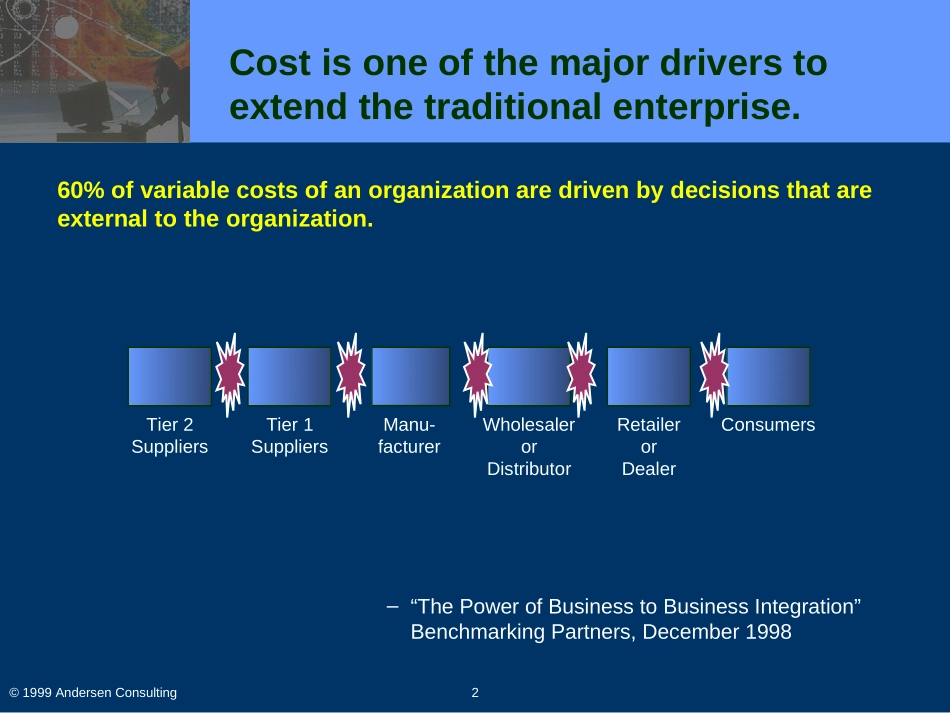

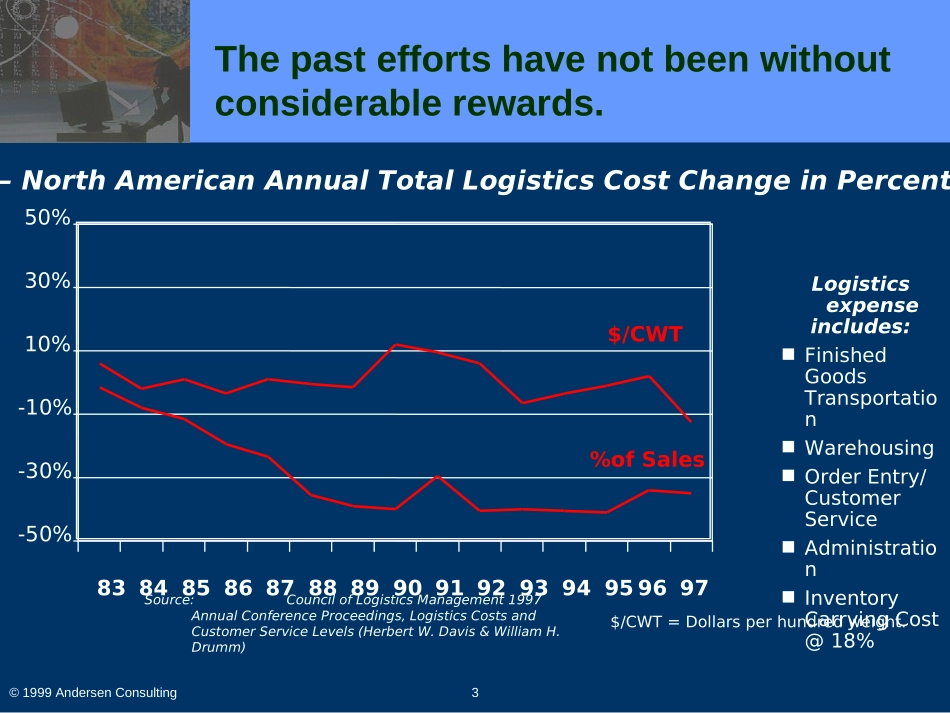

TheValuePropositionofSupplyChainManagement©1999AndersenConsulting2Manu-facturerTier2SuppliersTier1SuppliersWholesalerorDistributorRetailerorDealerConsumers–“ThePowerofBusinesstoBusinessIntegration”BenchmarkingPartners,December1998Costisoneofthemajordriverstoextendthetraditionalenterprise.60%ofvariablecostsofanorganizationaredrivenbydecisionsthatareexternaltotheorganization.©1999AndersenConsulting3Logisticsexpenseincludes:FinishedGoodsTransportationWarehousingOrderEntry/CustomerServiceAdministrationInventoryCarryingCost@18%—NorthAmericanAnnualTotalLogisticsCostChangeinPercentage—Source:CouncilofLogisticsManagement1997AnnualConferenceProceedings,LogisticsCostsandCustomerServiceLevels(HerbertW.Davis&WilliamH.Drumm)Thepasteffortshavenotbeenwithoutconsiderablerewards.-50%-30%-10%10%30%50%838485868788899091929394959697%ofSales$/CWT$/CWT=Dollarsperhundredweight.©1999AndersenConsulting414.09%10.40%9.06%11.85%13.28%11.96%14.06%8.77%7.42%5.80%3.87%6.52%7.29%6.35%8.08%4.32%TelecomSemiconductorPharmaceuticalPackagedGoodsComputerChemicalAppliancesAutomotiveBestinClassAverage12Source:LogisticsManagement,April1997Yet,supplychaincostreductionstillrepresentsasignificantbusinessopportunity…...SupplyChainSpendasaPercentageofRevenues$34$37$34$20$15$8$4$10$162$162SizeofGapinBillions©1999AndersenConsulting5VALUETHEORYholdsthattoincreasethevalueofacompany,youmustincreasecashearningsinexcessofitsfullcostofcapitalinasustainablefashionThesupplychainmustcontinuetodriveshareholdervalue.©1999AndersenConsulting6RevenueRevenueCostsCostsWorkingCapitalWorkingCapitalFixedCapitalFixedCapital—ImpactofSCM—Greatercustomerservice(i.e.,highermarketshare,greatergrossmargins)LowerrawmaterialsandfinishedgoodsinventoryShorter“order-to-cash”cyclesShareholderValueShareholderValueProfitabilityProfitabilityInvestedCapitalInvestedCapitalSCMhascontributedtoincreasedshareholdervaluebyimpactingtraditionalvaluelevers.Fewerphysicalassets(i.e.,trucks,warehouses,materialhandlingequipment,etc.)Lowercostofgoodssold,transportation,warehousing,materialhandlinganddistributionmanagementcosts©1999AndersenConsulting7CostsAssetsCustomerServiceStrategicandFinancialImpactStrategicandFinancialImpactTheimprovementofSCMhassignificantstrategicandfinancialimpactsonbottomlineactivities.ShareholderValueCreationCustomerServiceLevelIncreaseSupplyChainVariabilityReductionInventoryReductionCycle-timeCompressionFinancials/Metrics.Financials/Metrics.Financials/Metrics.Financials/Metrics.ROAROA94%94%98%98%In-stockavailabilityLeadtimeAbilitytotailortospecificcustomerneedsFixedPurchaseCostVariableManufacturingTrans/DistributionObsolescence/MarkdownAdministrative/TransactionManufacturingDistributionCentersInventory©1999AndersenConsulting8BestinClasscompaniesenjoysignificantadvantageovertheircompetitors.TotalSupply-ChainMgmt.Cost“Foracompanywithannualsalesof$2billionanda60%costofsales,thedifferencebetweenbeingatthemedianintermsofperformanceandbeinginthetop20%is$176millioninworkingcapital.”7.06.30%2%4%6%8%10%12%14%19961997RevenueBestMedian37318702040608010012019961997CalendarDaysCash-to-CashCycleTime13.111.61051997PRTMStudy©1999AndersenConsulting935347866010203040506070809010019961997DaysofSupply949471810%10%20%30%40%50%60%70%80%90%100%19961997TotalDaysofSupplyOn-TimeDeliveryPerformanceBestM...