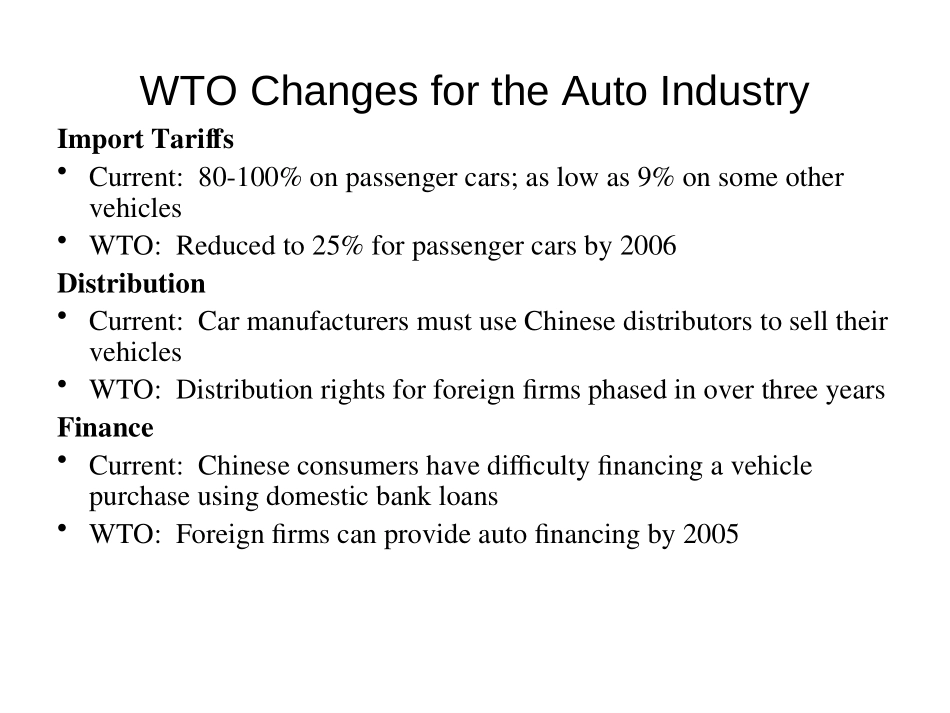

Economics145,Lecture7:China’sEntrytotheWTO:AViewfromtheAutoIndustry“FromImportSubstitutiontoWTOAccession:Gov’tInterventionintheChineseAutomobileMarket”RobertFeenstra,DanSperlingLeeBranstetter,EricHarwitWenHai,July5,2001WTOChangesfortheAutoIndustryImportTariffs•Current:80-100%onpassengercars;aslowas9%onsomeothervehicles•WTO:Reducedto25%forpassengercarsby2006Distribution•Current:CarmanufacturersmustuseChinesedistributorstoselltheirvehicles•WTO:DistributionrightsforforeignfirmsphasedinoverthreeyearsFinance•Current:Chineseconsumershavedifficultyfinancingavehiclepurchaseusingdomesticbankloans•WTO:Foreignfirmscanprovideautofinancingby2005WTOAccessionwillplacepressureonthedomesticChineseautoindustry•Qualitymustincrease–andithas–GM’sBuickassemblylineisstate-of-the-art–OtherJVshaveupgradedtheirmanufacturingtechnologyandproductquality•Costsmustcomedown–buttheywill–JVexecutivesmaintainedthatsqueezingatmost25%-30%outoftheirmanufacturingcostswouldenablethemtoremainpricecompetitivewithimportsBarrierstoimportpenetrationwillremaininthepost-WTOindustry•Mostmanagersonthegroundexpectimportstoincrease•Everymanageronthegroundexpectsnon-tariffbarrierstolimitimportpenetration–10-15%marketshareforimportedcars•DomesticdemandforcarswillcontinuetobesuppliedprincipallybydomesticsuppliersTheconsensusisthatdemandforcarswillcontinuetogrowslowly•MostJVmanufacturersexpecttheslowgrowthofthelate1990stocontinueintothemedium-termfuture•Theofficialstatisticssuggestthathouseholdincomeisgrowingmuchmoreslowlythantheeconomy•Officialgovernmentprojectionsextrapolatethegrowthofdomesticproductionoverthelastfiveyearsintothenextfive(13%compoundgrowthrate)•Theoutlier:GM–Historicalstudiessuggestthatthemassmarketforautomobiles“takesoff”whenpercapitaincomereachesathresholdlevel–“UrbancoastalChina”isatorveryclosetothislevel–OtherstudiesarelessoptimisticJVSelectedModelPrices2001BrandMarketSharein2000AveragePurchasePriceMay2001(Beijing/Tianjin)Santana18.2%RMB118,500($14,300)Santana200013.5%RMB135,000($16,300)Jetta2V13.3%RMB115,000($13,900)Alto8.9%RMB49,500($6,000)Charade7100U6.4%RMB67,600($8,200)Accord5.3%RMB290,800($35,120)Buick5.0%RMB350,000($42,300)AudiA62.6%RMB441,000($53,300)Source:ChinaBusinessUpdateAutostatistics,2001Taxesandfeesareextremelyhigh•ThecostofacquiringacarinShanghai–Directcostis$10,000(upto$40,000forBuick)–Driver’slicensecost$500(plus2monthsofintensivetraining/testing)–8%consumptiontax:$800–Registrationfee:$2,500–17%vat:$1,700–Otheroperatingcosts(fees,tolls,etc.)–FuelcostsarecomparabletotheUS–Per-capitaincome:<$4,000peryearSource:ITS-DavisPewStudy,2001DataandhistoryseemtobeonthesideofthepessimistsCountry/EraPriceofmass-consumervehiclePercapitaGNPRatioofpricetopercapitaGNP1920sUS650850.761960sUS25003000.83China(nominal)1000075013.3China(PPP)1000035002.57Shanghai(PPP)10000100001Source:Harwit,CAJ,April/May1999UrbanroadwaysarecongestedandparkingislimitedCityTotalPopulationNumberofparkingspacesRatioofPopulationtoParkingSpacesPortland450,00042,000(1996)11Frankfurt625,00085,000(1989)7Beijing11,000,000360,000(1998)31Guangzhou6,000,00010,000(1994)600Source:Harwit,CAJ,February/March1999Growthindemandwillbeconcentratedatthelowend•Officialgovernmentplansnowfocusonthe80,000RMBcar(about$9,700)•AllJVsareseekingtointroduce“economymodels”•MostJVproductionhasbeenforciblysteer...