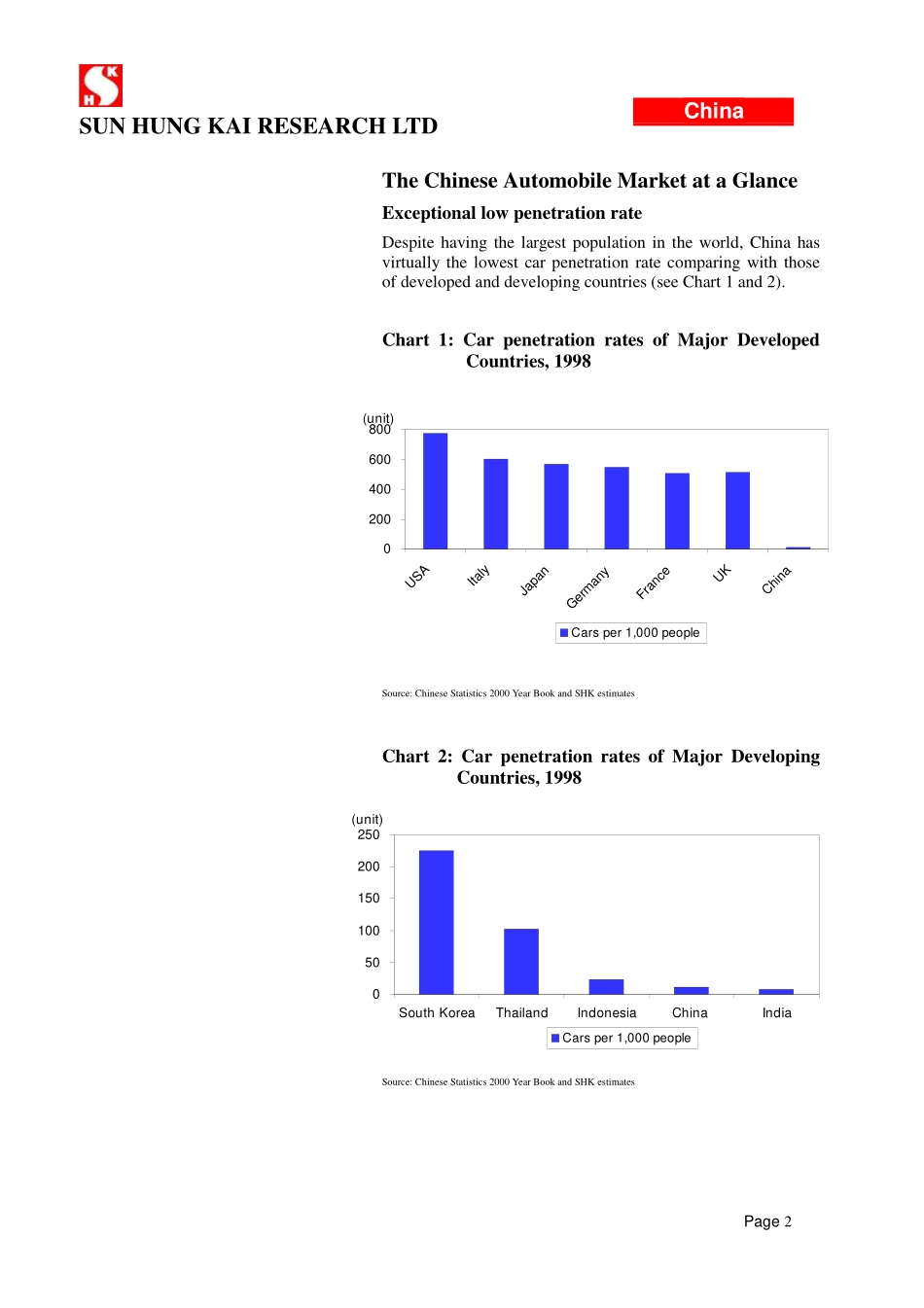

ChinaSUNHUNGKAIRESEARCHLTDOverweightChinaAutomobileSectorTheWheelsaretheWingsofChina20Jul2001HongKongJosephTang(852)21065910joseph.tang@shkco.comOdeliaLeung(852)21068212odelia.leung@shkco.comChinaTonyYam(8621)63867069tony.yam@shkco.comChenRong(8621)63867069conriechr@sina.comPage1ChinaSUNHUNGKAIRESEARCHLTDInvestmentSummaryThewheelsarerollingfast.Theunderlyinggrowthpotentialoftheautomobileindustryisbeingtranslatedtodemandalongwithrobusteconomicgrowth.Anannualdemandof3mvehiclesispredictedin2005.Risingaffordabilityisthemajorgrowthengine.AffordabilityisrisingatafasterspeedthanGDPpercapita.Affordabilitywillbefurtherenhancedbyincreasingpopularityofautofinancingandfallingpricesasaresultofpersistentpricecompetition.Favourablegovernmentpoliciesarethelubricant.IntheTenthFive-YearPlan,privateownershipofcarsisencouraged.Governmentviewsindustryconsolidationtobenecessaryandconstructivetothelong-termwell-beingofautomobileindustry.WTObringsbothchallengesandopportunities.ThenegativeimpactofChina’sentrytotheWTOcanbemitigatedbydevelopinglong-termcompetitivenessthroughindustryconsolidation.WefavourDenwayandBrillianceChina.Inadditiontotheirbetterfundamentalsandtrackrecords,weareoptimistictothefutureprospectsoftheirsedanbusinesses.WealsofavourDongfengandXiamenAutomobile.Astheyareexpectedtobethemajorautogiantsafterindustryconsolidation,theydeservespecialpremium.CompanyNameStockCodeSharePriceHistoricPER12MonthTargetPrice3/12MonthsRecommendationHongKongListedDenwayMotors203.HKHK$2.6517.21HK$3.60Buy/BuyBrillianceChina1114.HKHK$1.635.36HK$3.00StrongBuy/StrongBuyQinglingMotors1122.HKHK$1.475.65HK$1.53Hold/HoldPRClistedAsharesShanghaiAutomobile600104.SSRMB9.4431.47RMB10.50Hold/HoldDongfengAutomobile600006.SSRMB10.2827.78RMB13.00Hold/BuyXiamenMotor600686.SSRMB13.1054.58RMB15.50Hold/BuyBsharesChongqingChanganAuto2625.SZRMB3.6832.51RMB4.30Hold/HoldNote:Allpricesrefertotheclosingpriceson18July2001Page2ChinaSUNHUNGKAIRESEARCHLTDTheChineseAutomobileMarketataGlanceExceptionallowpenetrationrateDespitehavingthelargestpopulationintheworld,Chinahasvirtuallythelowestcarpenetrationratecomparingwiththoseofdevelopedanddevelopingcountries(seeChart1and2).Chart1:CarpenetrationratesofMajorDevelopedCountries,1998Source:ChineseStatistics2000YearBookandSHKestimatesChart2:CarpenetrationratesofMajorDevelopingCountries,1998Source:ChineseStatistics2000YearBookandSHKestimates0200400600800USAItalyJapanGermanyFranceUKChina(unit)Carsper1,000people050100150200250SouthKoreaThailandIndonesiaChinaIndia(unit)Carsper1,000peoplePage3ChinaSUNHUNGKAIRESEARCHLTDIn1998,theaveragecarpenetrationrateofprosperousChinesecitieswasabout114carsper1,000peoplewhichwasmuchhigherthanthenationalrateof11carsper1,000people.However,itwasstillonlyequivalentto1/7ofthatoftheUS.TofurtherillustratetheenormousgrowthpotentialofChina’sautomobilemarket,let’slookattherelationshipbetweenGDPpercapitaandcarpenetrationrate(seethelistbelow).Carper1,000peopleGDPpercapita(USD)GDPpercapita/carpenetrationrateUSA77532,47742Japan56731,25555Germany54626,23448France50724,87749UK51423,99347Italy60121,12035Korea2256,90131Thailand1021,82018Indonesia2346420China1176269India843254Source:SHKestimateTheabovelisthasrevealedtwofacts:Fact1:ThehigherGDPpercapita,thehigherthecarpenetrationrateImplication:WhileChinaisexpectedtomaintainarealGDPgrowthratebetween7%-8%inthecomingfiveyears,we...