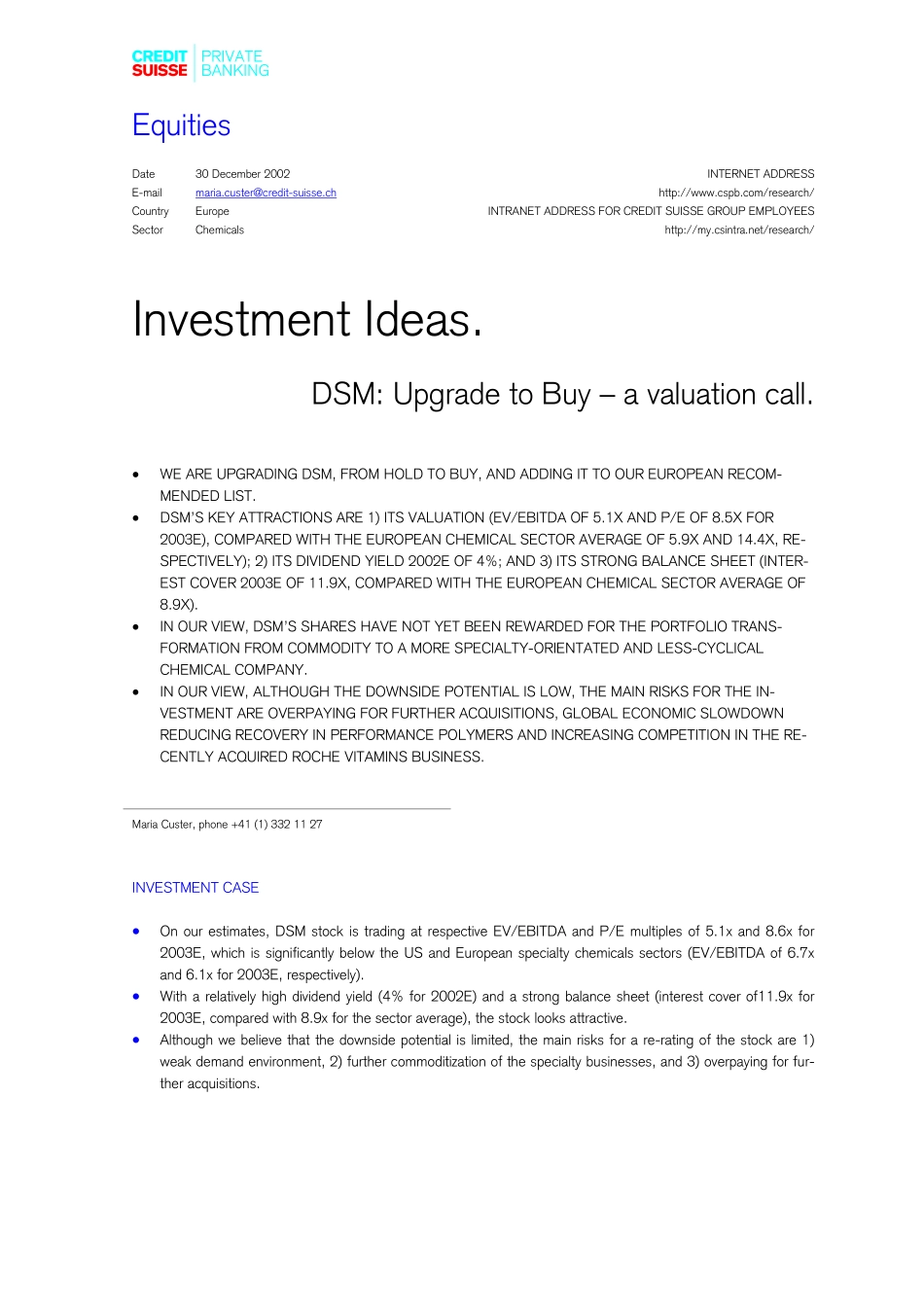

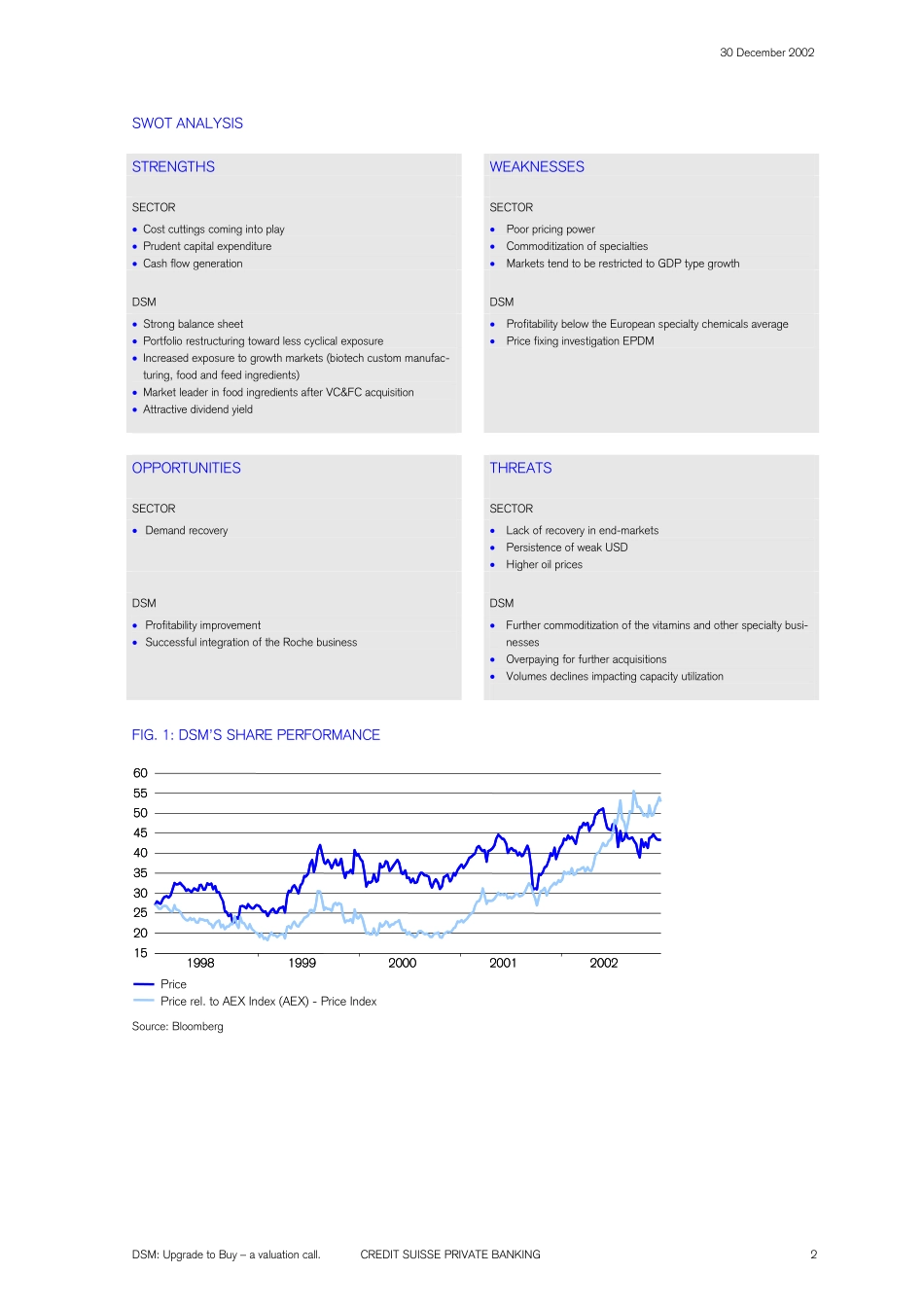

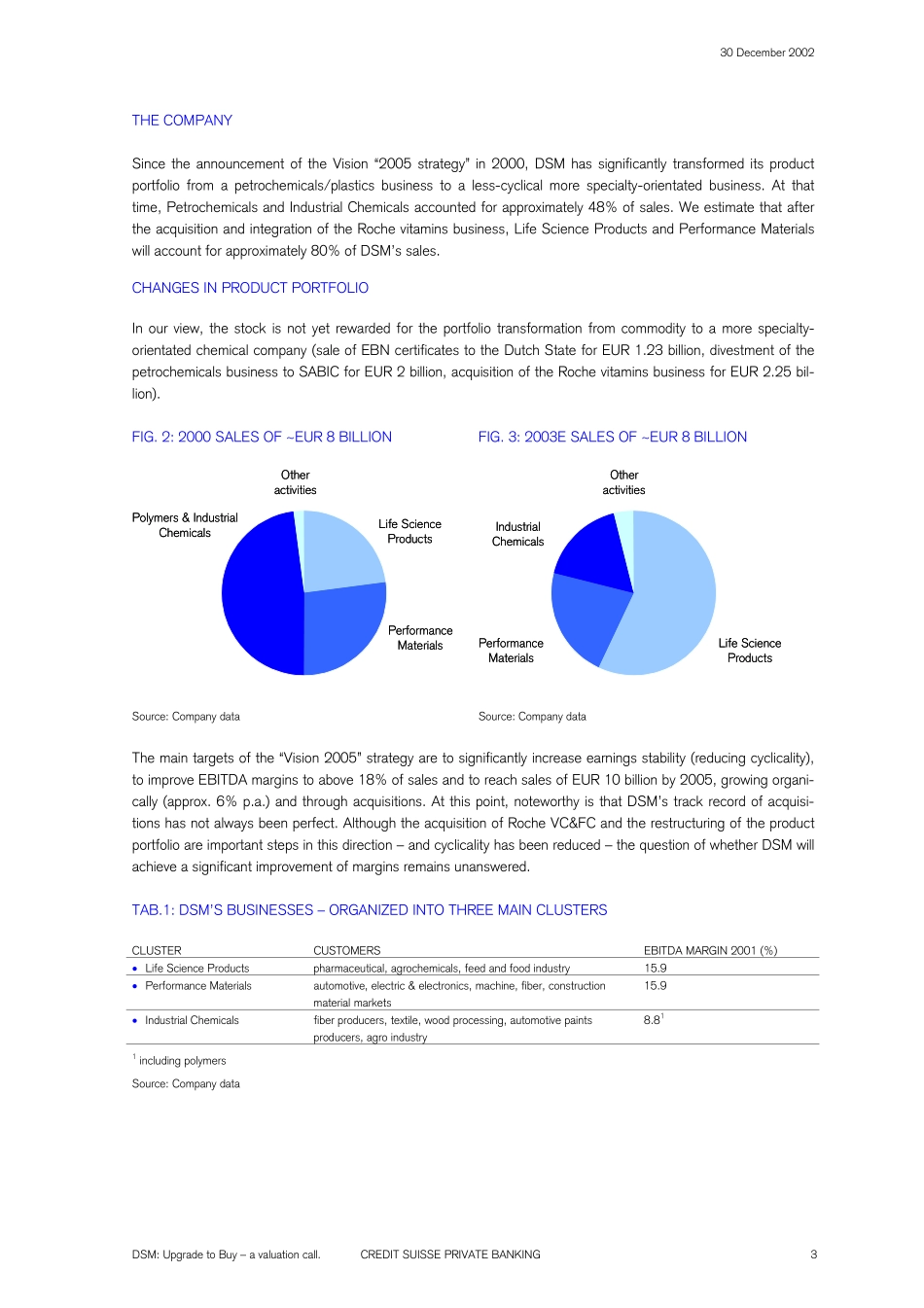

EquitiesDate30December2002INTERNETADDRESSE-mailmaria.custer@credit-suisse.chhttp://www.cspb.com/research/CountryEuropeINTRANETADDRESSFORCREDITSUISSEGROUPEMPLOYEESSectorChemicalshttp://my.csintra.net/research/InvestmentIdeas.DSM:UpgradetoBuy–avaluationcall.•WEAREUPGRADINGDSM,FROMHOLDTOBUY,ANDADDINGITTOOUREUROPEANRECOM-MENDEDLIST.•DSM’SKEYATTRACTIONSARE1)ITSVALUATION(EV/EBITDAOF5.1XANDP/EOF8.5XFOR2003E),COMPAREDWITHTHEEUROPEANCHEMICALSECTORAVERAGEOF5.9XAND14.4X,RE-SPECTIVELY);2)ITSDIVIDENDYIELD2002EOF4%;AND3)ITSSTRONGBALANCESHEET(INTER-ESTCOVER2003EOF11.9X,COMPAREDWITHTHEEUROPEANCHEMICALSECTORAVERAGEOF8.9X).•INOURVIEW,DSM’SSHARESHAVENOTYETBEENREWARDEDFORTHEPORTFOLIOTRANS-FORMATIONFROMCOMMODITYTOAMORESPECIALTY-ORIENTATEDANDLESS-CYCLICALCHEMICALCOMPANY.•INOURVIEW,ALTHOUGHTHEDOWNSIDEPOTENTIALISLOW,THEMAINRISKSFORTHEIN-VESTMENTAREOVERPAYINGFORFURTHERACQUISITIONS,GLOBALECONOMICSLOWDOWNREDUCINGRECOVERYINPERFORMANCEPOLYMERSANDINCREASINGCOMPETITIONINTHERE-CENTLYACQUIREDROCHEVITAMINSBUSINESS.MariaCuster,phone+41(1)3321127INVESTMENTCASE•Onourestimates,DSMstockistradingatrespectiveEV/EBITDAandP/Emultiplesof5.1xand8.6xfor2003E,whichissignificantlybelowtheUSandEuropeanspecialtychemicalssectors(EV/EBITDAof6.7xand6.1xfor2003E,respectively).•Witharelativelyhighdividendyield(4%for2002E)andastrongbalancesheet(interestcoverof11.9xfor2003E,comparedwith8.9xforthesectoraverage),thestocklooksattractive.•Althoughwebelievethatthedownsidepotentialislimited,themainrisksforare-ratingofthestockare1)weakdemandenvironment,2)furthercommoditizationofthespecialtybusinesses,and3)overpayingforfur-theracquisitions.30December2002DSM:UpgradetoBuy–avaluationcall.CREDITSUISSEPRIVATEBANKING2SWOTANALYSISSTRENGTHSWEAKNESSESSECTORSECTOR•Costcuttingscomingintoplay•Prudentcapitalexpenditure•Cashflowgeneration•Poorpricingpower•Commoditizationofspecialties•MarketstendtoberestrictedtoGDPtypegrowthDSMDSM•Strongbalancesheet•Portfoliorestructuringtowardlesscyclicalexposure•Increasedexposuretogrowthmarkets(biotechcustommanufac-turing,foodandfeedingredients)•MarketleaderinfoodingredientsafterVC&FCacquisition•Attractivedividendyield•ProfitabilitybelowtheEuropeanspecialtychemicalsaverage•PricefixinginvestigationEPDMOPPORTUNITIESTHREATSSECTORSECTOR•Demandrecovery•Lackofrecoveryinend-markets•PersistenceofweakUSD•HigheroilpricesDSMDSM•Profitabilityimprovement•SuccessfulintegrationoftheRochebusiness•Furthercommoditizationofthevitaminsandotherspecialtybusi-nesses•Overpayingforfurtheracquisitions•VolumesdeclinesimpactingcapacityutilizationFIG.1:DSM’SSHAREPERFORMANCE19981999200020012002152025303540455055601998199920002001200215202530354045505560PricePricerel.toAEXIndex(AEX)-PriceIndexSource:Bloomberg30December2002DSM:UpgradetoBuy–avaluationcall.CREDITSUISSEPRIVATEBANKING3THECOMPANYSincetheannouncementoftheVision“2005strategy”in2000,DSMhassignificantlytransformeditsproductportfoliofromapetrochemicals/plasticsbusinesstoaless-cyclicalmorespecialty-orientatedbusiness.Atthattime,PetrochemicalsandIndustrialChemicalsaccountedforapproximately48%ofsales.WeestimatethataftertheacquisitionandintegrationoftheRochevitaminsbusiness,LifeScienceProductsandPerformanceMaterialswillaccountforapproximately80%ofDSM’ssales.CHANGESINPRODUCTPORTFOLIOInourview,thestockisnotyetrewardedfortheportfoliotransformationfromcommod...