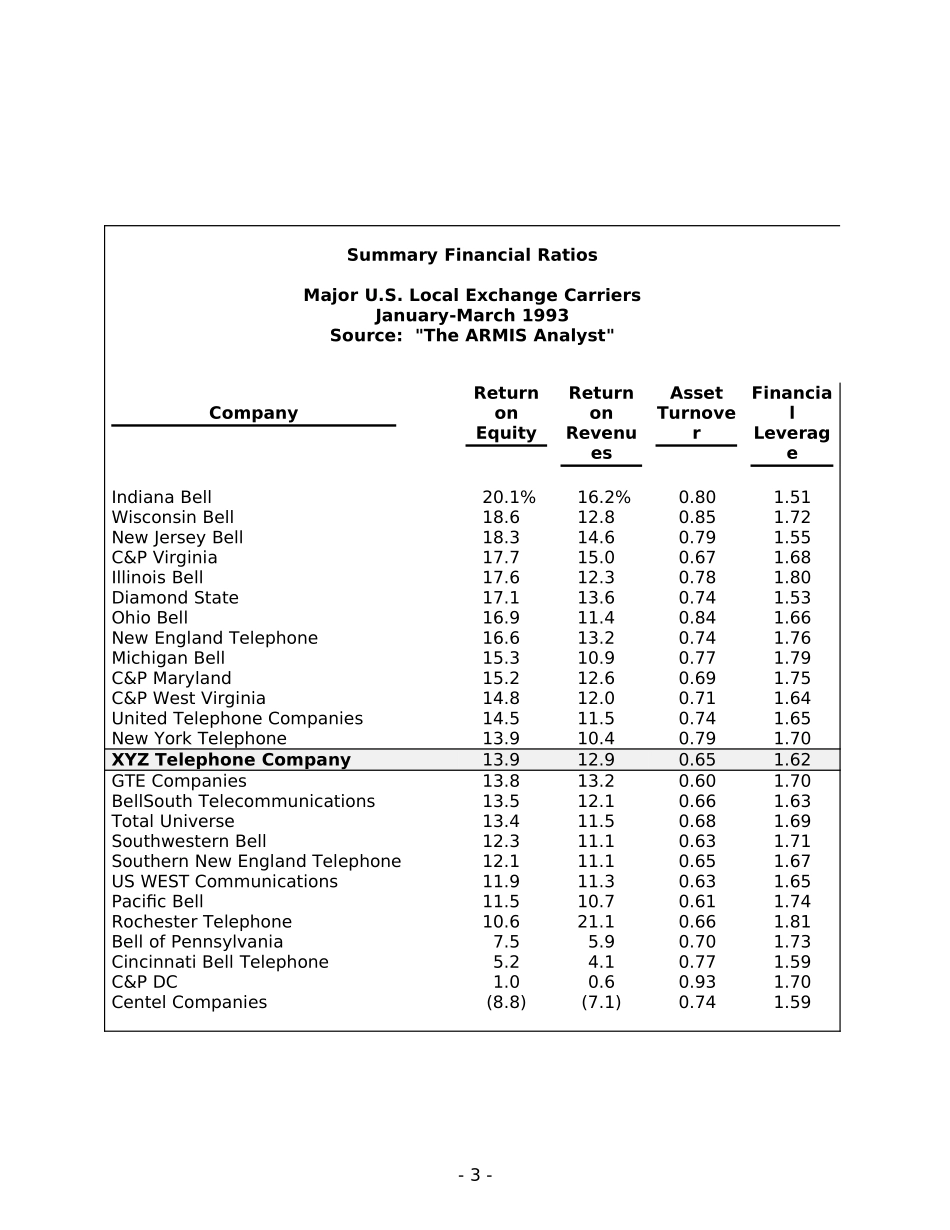

TheNeedforaValueDriverModelOneofthemostimportantissuesforexecutivestodayinthetelephoneindustryis,"HowdoIbetterfocustheorganizationonthekeydriversoflong-termsuccessandimproveperformanceandaccountability."Thecompaniesinwhichthemanagementteamclearlyunderstandsthefundamentaldriversofthebusiness'value,planswithrespecttothesedrivers,andappliesthedisciplinenecessarytoimplementtheirplanswillbetheultimatewinners.Foryears,companieshaveknownthatfactors,suchassegmentprofitability,networkcapacitiesandutilization,workgroupproductivity,etc.,drivetheoverallfinancialperformanceofthebusiness.Companiesaretryingtogainabetterunderstandingofthelinkageamongthesefactors.Performancemeasuresarebeingredefinedtoseparatewhatisbeneficialandimportantfromwhatisnot.Theefforttoreevaluateandmeasurethevaluedriversofthebusinessprovidesseniormanagerswithrelevantfactsaboutoverallfinancialandmarketperformanceandfunctionalmanagerswithabetterunderstandingoftheircontributiontoawhole.-1-BeginningattheTopOurapproachbeginsbyfocusingonoverallfinancialperformance.Weuseatraditionalmeasure,returnonaverageshareholder'sequity("ROE"),becauseitisakeymeasureontopmanagement"scorecards."1Wealsorecognizetheimportanceofmeasuresofmarketperformance,quality,customersatisfaction,andinnovationinthebusiness.WeknowthatROEisdrivenbythreefactors:incomerealizedperdollarofrevenue(returnonrevenues),thelevelofrevenuesgeneratedperdollarofassets(assetturnover),andtheextenttowhichassetsarefundedbyequityratherthandebtorothersources(leverage).·Returnonrevenuesis,inturn,drivenbytheprofitabilityorcontributionsofeachbusinesssegment,lessthecostsofthecommonnetworkinfrastructureandothercommoncorporatecosts.Wewanttoclearlyunderstandandmeasuretheseandthefactorsunderlyingthem.·Assetturnoverisdrivenbythemixofplanttypes(access,switching,interofficetransport,etc.)andtheirtechnologies,plantcapacitiesandthecostsofcapacity,andplantutilization.Asimportantasunderstandingthestateofexistingplantisunderstandingthevaluedriversinherentinengineeringdecisionprocesseswhichbuildfuturenetworkcapabilitiesandcapacitiesandultimatelydrivesegmentprofitability.Finally,whileitisobviouslyveryimportant,wesetasidefinancialstrategy(leverage)sothatwecanfocusonthemarketingandoperationalfactorsdrivingoverallperformance.1Othermeasurescanbeused,suchaseconomicvalueadded("EVA"),whichisreceivingagooddealofattentionasanindicatorofshareownervaluecreation.-2-SummaryFinancialRatiosMajorU.S.LocalExchangeCarriersJanuary-March1993Source:"TheARMISAnalyst"CompanyReturnonEquityReturnonRevenuesAssetTurnoverFinancialLeverageIndianaBell20.1%16.2%0.801.51WisconsinBell18.612.80.851.72NewJerseyBell18.314.60.791.55C&PVirginia17.715.00.671.68IllinoisBell17.612.30.781.80DiamondState17.113.60.741.53OhioBell16.911.40.841.66NewEnglandTelephone16.613.20.741.76MichiganBell15.310.90.771.79C&PMaryland15.212.60.691.75C&PWestVirginia14.812.00.711.64UnitedTelephoneCompanies14.511.50.741.65NewYorkTelephone13.910.40.791.70XYZTelephoneCompany13.912.90.651.62GTECompanies13.813.20.601.70BellSouthTelecommunications13.512.10.661.63TotalUniverse13.411.50.681.69SouthwesternBell12.311.10.631.71SouthernNewEnglandTelephone12.111.10.651.67USWESTCommunications11.911.30.631.65PacificBell11.510.70.611.74RochesterTelephone10.621.10.661.81BellofPennsylvania7.55.90.701.73CincinnatiBellTelephone5.24.10.771.59C&PDC1.00.60.931.70CentelCom...