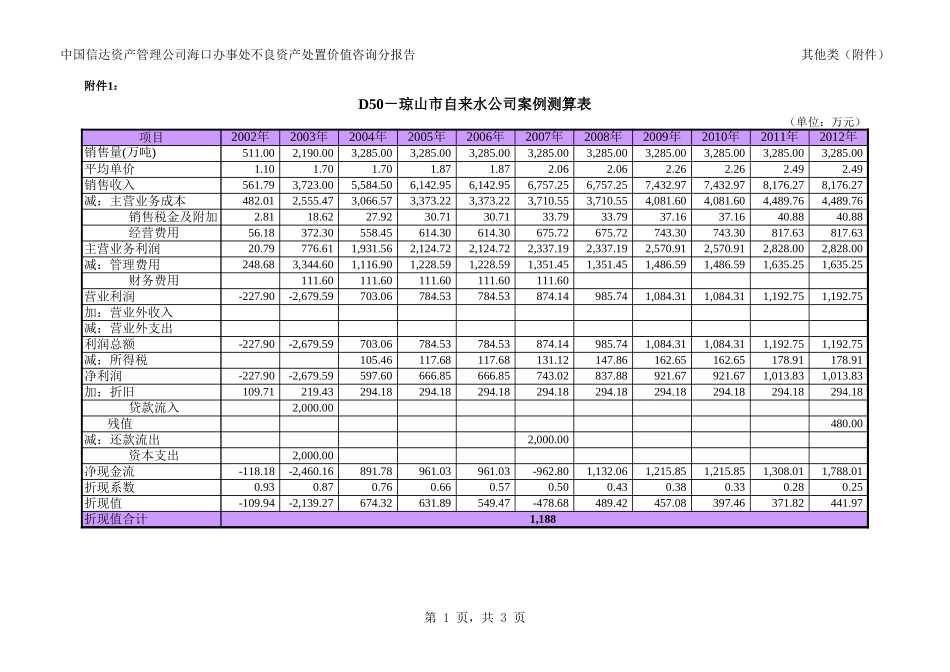

中国信达资产管理公司海口办事处不良资产处置价值咨询分报告其他类(附件)第1页,共3页(单位:万元)项目511.002,190.003,285.003,285.003,285.003,285.003,285.003,285.003,285.003,285.003,285.00平均单价1.101.701.701.871.872.062.062.262.262.492.49销售收入561.793,723.005,584.506,142.956,142.956,757.256,757.257,432.977,432.978,176.278,176.27减:主营业务成本482.012,555.473,066.573,373.223,373.223,710.553,710.554,081.604,081.604,489.764,489.762.8118.6227.9230.7130.7133.7933.7937.1637.1640.8840.8856.18372.30558.45614.30614.30675.72675.72743.30743.30817.63817.63主营业务利润20.79776.611,931.562,124.722,124.722,337.192,337.192,570.912,570.912,828.002,828.00减:管理费用248.683,344.601,116.901,228.591,228.591,351.451,351.451,486.591,486.591,635.251,635.25111.60111.60111.60111.60111.60营业利润-227.90-2,679.59703.06784.53784.53874.14985.741,084.311,084.311,192.751,192.75加:营业外收入减:营业外支出利润总额-227.90-2,679.59703.06784.53784.53874.14985.741,084.311,084.311,192.751,192.75减:所得税105.46117.68117.68131.12147.86162.65162.65178.91178.91净利润-227.90-2,679.59597.60666.85666.85743.02837.88921.67921.671,013.831,013.83加:折旧109.71219.43294.18294.18294.18294.18294.18294.18294.18294.18294.182,000.00480.00减:还款流出2,000.002,000.00净现金流-118.18-2,460.16891.78961.03961.03-962.801,132.061,215.851,215.851,308.011,788.01折现系数0.930.870.760.660.570.500.430.380.330.280.25折现值-109.94-2,139.27674.32631.89549.47-478.68489.42457.08397.46371.82441.97折现值合计1,188附件1:D50-琼山市自来水公司案例测算表2002年2003年2004年2005年2006年2007年2008年2009年2010年2011年2012年销售量(万吨)销售税金及附加经营费用财务费用贷款流入残值资本支出中国信达资产管理公司海口办事处不良资产处置价值咨询分报告其他类(附件)第2页,共3页假设一:需进行职工安置(单位:万元)年份产量(吨)8.0016.0016.0020.8021.4222.0722.7323.4124.112.004.004.005.205.365.525.685.856.0310.0020.0020.0026.0026.7827.5828.4129.2630.14单价(元)240.00235.20230.50225.89221.37216.94212.60208.35204.18270.00264.60259.31254.12249.04244.06239.18234.39229.71主营业务收入2,460.004,821.604,725.176,019.866,076.456,133.576,191.226,249.426,308.17减:主营业务成本1,431.972,897.442,931.624,051.634,214.624,384.904,744.164,934.775,133.888.2715.8715.2118.9118.6018.2717.9017.5117.08主营业务利润1,019.761,908.281,778.341,949.321,843.231,730.401,429.161,297.151,157.20减:营业费用420.00840.00840.001,092.001,124.761,158.501,193.261,229.061,265.9317.5035.0035.0042.5043.2844.0846.5647.4148.290.000.000.0044.6444.6444.6444.6444.64税前利润582.261,033.28903.34770.18630.55483.18144.70-23.96-157.02税后利润494.92878.29767.84654.65535.97410.70123.00-23.96-157.02加:折旧0.000.000.0064.6064.6064.6064.6076.0076.00800.00224.00减:改扩建资本支出-800.00-800.00-400.00-200.00净现金流-105.08878.29767.84719.25600.57475.30187.60-747.96142.98折现系数0.930.810.700.610.530.460.400.350.30各年折现值-97.75710.45540.09439.92319.42219.8275.44-261.5743.48折现价值合计1,989附件2-1:D54-海南省白翔水泥厂案例测算表(2-1)2002年2003年2004年2005年2006年2007年2008年2009年2010年主营业务税金及附加管理费用财务费用贷款流入资金残值回收还贷流出资金职工安置费补偿承包人中国信达资产管理公司海口办事处不良资产处置价值咨询分报告其他类(附件)第3页,共3页假设二:无需进行职工安置(单位:万元)年份产量(吨)8.0016.0016.0020.8021.4222.0722.7323.4124.112.004.004.005.205.365.525.685.856.0310.0020.0020.0026.0026.7827.5828.41...