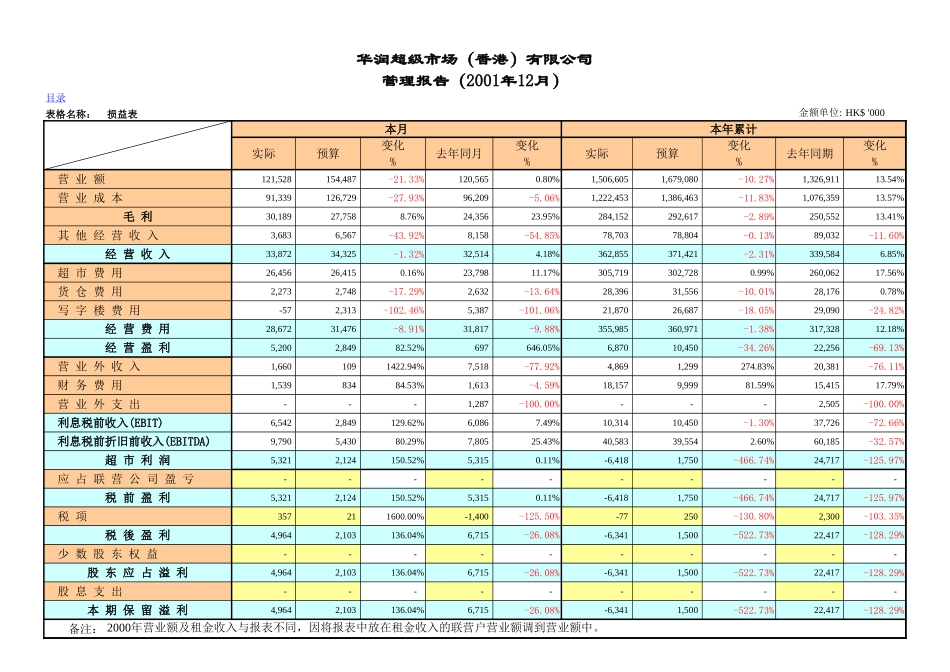

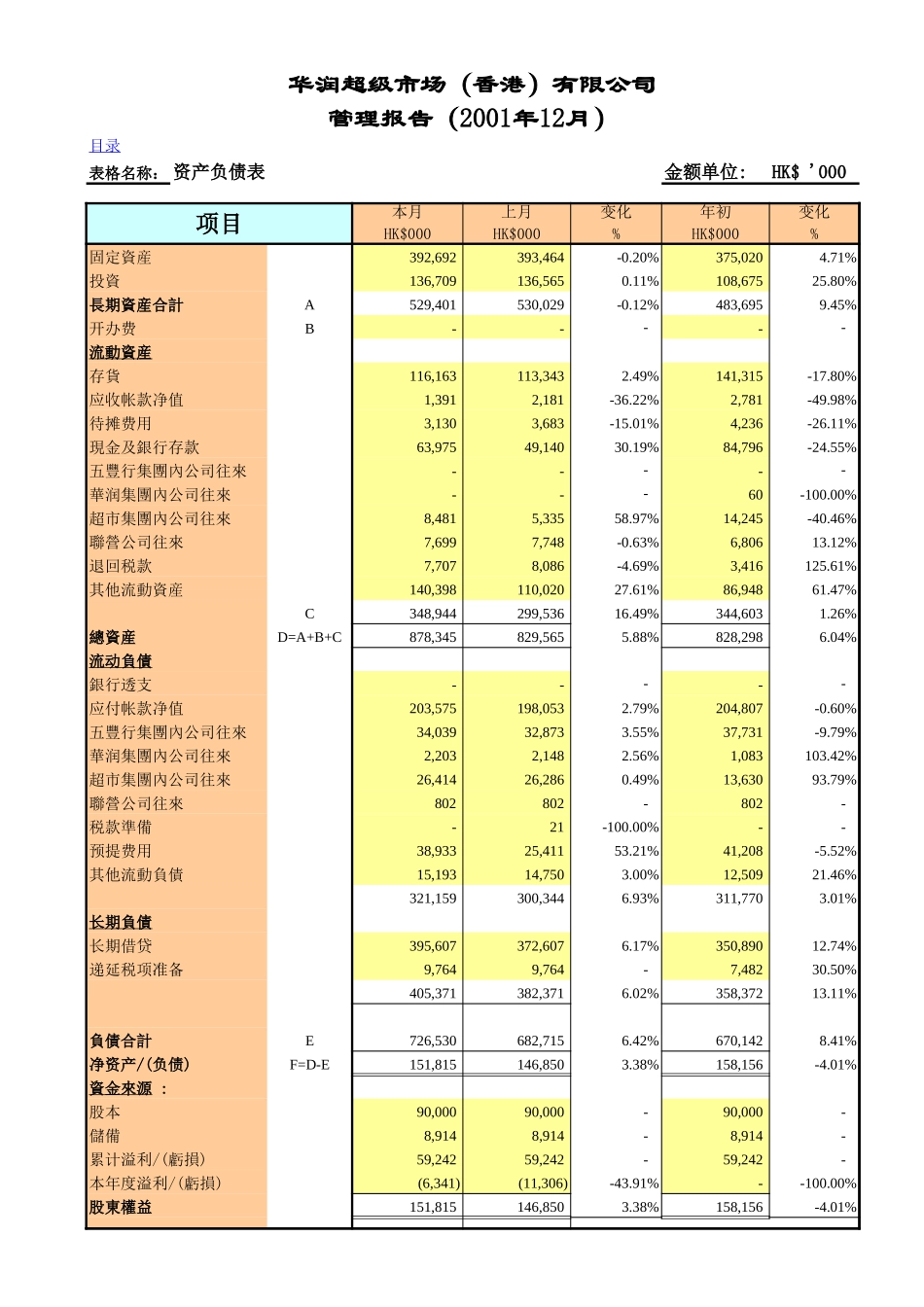

表格名称表格号码损益表1资产负债表2现金流量表3营业额分析表4毛利分析表5总费用分析表6超市费用明细分析表7货仓费用明细分析表8写字楼及财务费用明细分析表9财务数据分析1011应收帐款分析12应付帐款及存货分析13信用天数分析14坪效统计表15内部交易及往来帐披露表16内部调节表17财务分析18填表人:报表填写日期:复核人:报送日期:联络电话:电邮地址:华润超级市场(香港)有限公司管理报告(2001年12月)固定资产变动表(累计)华润超级市场(香港)有限公司表格名称:损益表HK$'000本月本年累计实际预算变化去年同月变化实际预算变化去年同期变化%%%%营业额121,528154,487-21.33%120,5650.80%1,506,6051,679,080-10.27%1,326,91113.54%营业成本91,339126,729-27.93%96,209-5.06%1,222,4531,386,463-11.83%1,076,35913.57%30,18927,7588.76%24,35623.95%284,152292,617-2.89%250,55213.41%其他经营收入3,6836,567-43.92%8,158-54.85%78,70378,804-0.13%89,032-11.60%经营收入33,87234,325-1.32%32,5144.18%362,855371,421-2.31%339,5846.85%超市费用26,45626,4150.16%23,79811.17%305,719302,7280.99%260,06217.56%货仓费用2,2732,748-17.29%2,632-13.64%28,39631,556-10.01%28,1760.78%写字楼费用-572,313-102.46%5,387-101.06%21,87026,687-18.05%29,090-24.82%经营费用28,67231,476-8.91%31,817-9.88%355,985360,971-1.38%317,32812.18%经营盈利5,2002,84982.52%697646.05%6,87010,450-34.26%22,256-69.13%营业外收入1,6601091422.94%7,518-77.92%4,8691,299274.83%20,381-76.11%财务费用1,53983484.53%1,613-4.59%18,1579,99981.59%15,41517.79%营业外支出---1,287-100.00%---2,505-100.00%6,5422,849129.62%6,0867.49%10,31410,450-1.30%37,726-72.66%9,7905,43080.29%7,80525.43%40,58339,5542.60%60,185-32.57%超市利润5,3212,124150.52%5,3150.11%-6,4181,750-466.74%24,717-125.97%应占联营公司盈亏----------税前盈利5,3212,124150.52%5,3150.11%-6,4181,750-466.74%24,717-125.97%357211600.00%-1,400-125.50%-77250-130.80%2,300-103.35%税後盈利4,9642,103136.04%6,715-26.08%-6,3411,500-522.73%22,417-128.29%----------股东应占溢利4,9642,103136.04%6,715-26.08%-6,3411,500-522.73%22,417-128.29%股息支出----------本期保留溢利4,9642,103136.04%6,715-26.08%-6,3411,500-522.73%22,417-128.29%备注:管理报告(2001年12月)目录金额单位:毛利利息税前收入(EBIT)利息税前折旧前收入(EBITDA)税项少数股东权益2000年营业额及租金收入与报表不同,因将报表中放在租金收入的联营户营业额调到营业额中。华润超级市场(香港)有限公司表格名称:资产负债表HK$'000项目本月上月变化年初变化HK$000HK$000%HK$000%固定資産392,692393,464-0.20%375,0204.71%投資136,709136,5650.11%108,67525.80%長期資産合計A529,401530,029-0.12%483,6959.45%开办费B-----流動資産存貨116,163113,3432.49%141,315-17.80%应收帐款净值1,3912,181-36.22%2,781-49.98%待摊费用3,1303,683-15.01%4,236-26.11%現金及銀行存款63,97549,14030.19%84,796-24.55%五豐行集團內公司往來-----華润集團內公司往來---60-100.00%超市集團內公司往來8,4815,33558.97%14,245-40.46%聯營公司往來7,6997,748-0.63%6,80613.12%退回税款7,7078,086-4.69%3,416125.61%其他流動資産140,398110,02027.61%86,94861.47%C348,944299,53616.49%344,6031.26%總資産D=A+B+C878,345829,5655.88%828,2986.04%流动負債銀行透支-----应付帐款净值203,575198,0532.79%204,807-0.60%五豐行集團內公司往來34,03932,8733.55%37,731-9.79%華润集團內公司往來2,2032,1482.56%1,083103.42%超市集團內公司往來26,41426,2860.49%13,63093.79%聯營公司往來802802-802-税款準備-21-100.00%--预提费用38,93325,41153.21%41,208-5.52%其他流動負債15,19314,7503.00%12,50921.46%321,159300,3446.93%311,7703.01%长期負債长期借贷395,607372,6076.17%350,89012.74%递延税项准备9,7649,764-7,48230.50%405,371382,3716.02%358,37213.11...