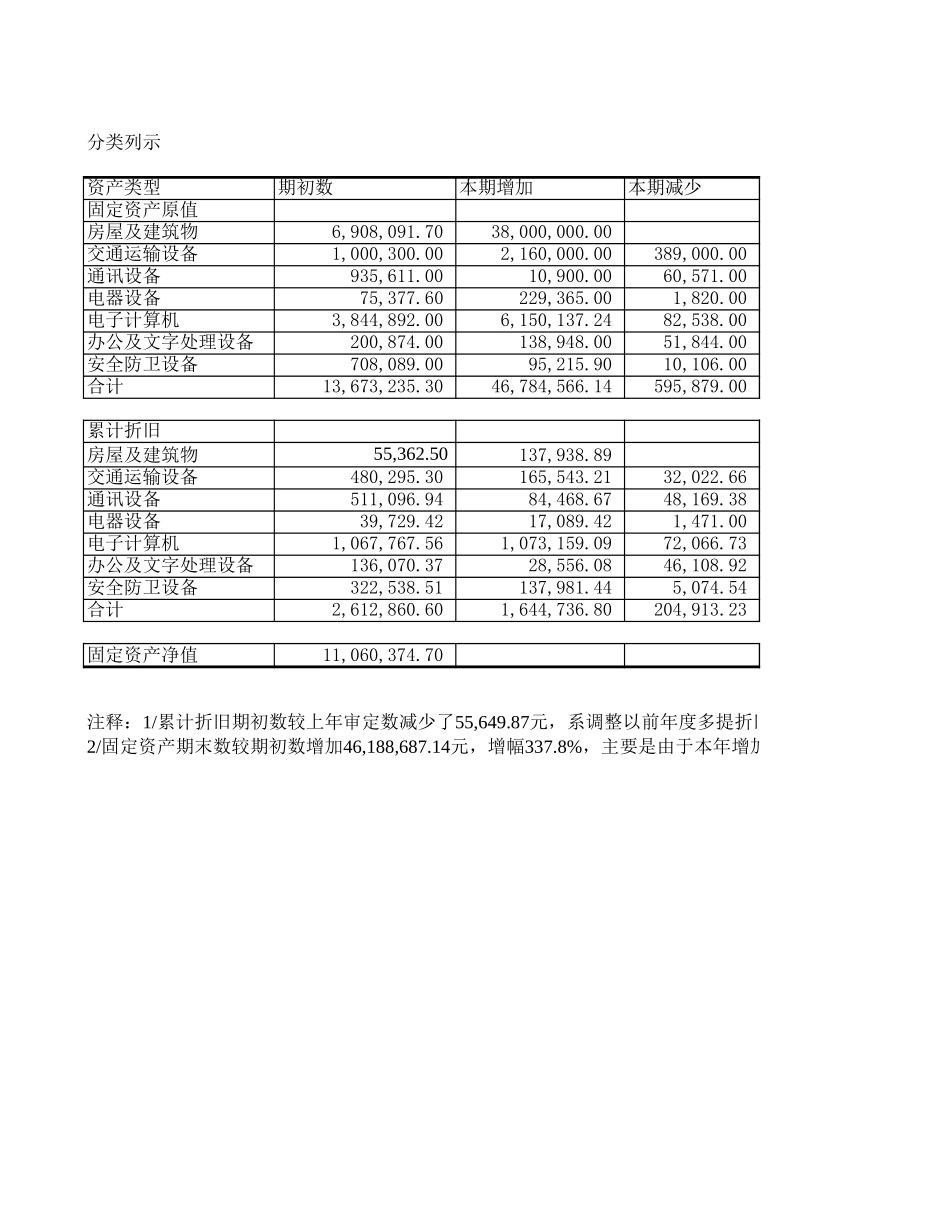

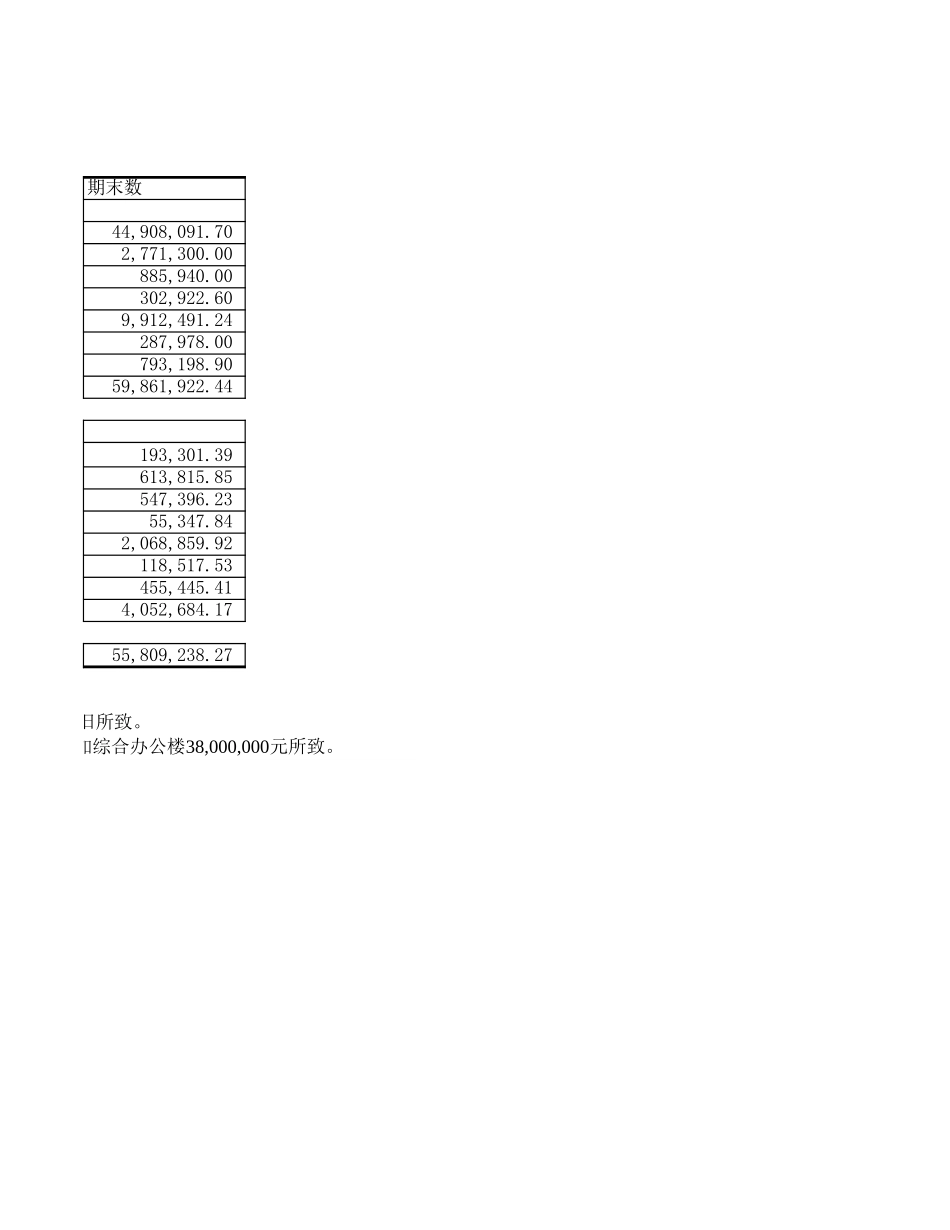

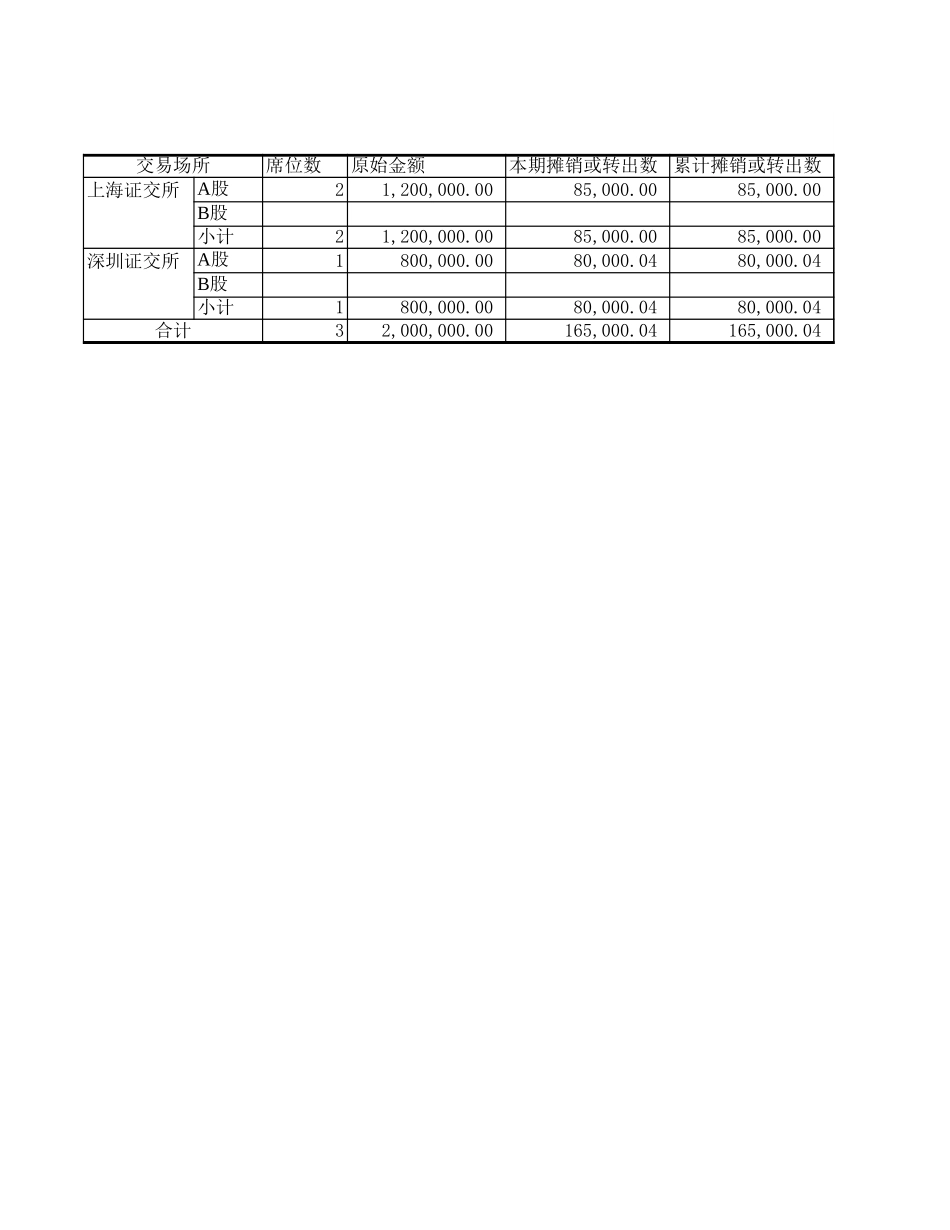

分类列示资产类型期初数本期增加本期减少固定资产原值房屋及建筑物6,908,091.7038,000,000.00交通运输设备1,000,300.002,160,000.00389,000.00通讯设备935,611.0010,900.0060,571.00电器设备75,377.60229,365.001,820.00电子计算机3,844,892.006,150,137.2482,538.00办公及文字处理设备200,874.00138,948.0051,844.00安全防卫设备708,089.0095,215.9010,106.00合计13,673,235.3046,784,566.14595,879.00累计折旧房屋及建筑物55,362.50137,938.89交通运输设备480,295.30165,543.2132,022.66通讯设备511,096.9484,468.6748,169.38电器设备39,729.4217,089.421,471.00电子计算机1,067,767.561,073,159.0972,066.73办公及文字处理设备136,070.3728,556.0846,108.92安全防卫设备322,538.51137,981.445,074.54合计2,612,860.601,644,736.80204,913.23固定资产净值11,060,374.70注释:1/累计折旧期初数较上年审定数减少了55,649.87元,系调整以前年度多提折旧所致。2/固定资产期末数较期初数增加46,188,687.14元,增幅337.8%,主要是由于本年增加综合办公楼期末数44,908,091.702,771,300.00885,940.00302,922.609,912,491.24287,978.00793,198.9059,861,922.44193,301.39613,815.85547,396.2355,347.842,068,859.92118,517.53455,445.414,052,684.1755,809,238.27元,系调整以前年度多提折旧所致。,主要是由于本年增加综合办公楼38,000,000元所致。交易场所席位数原始金额本期摊销或转出数累计摊销或转出数上海证交所21,200,000.0085,000.0085,000.00小计21,200,000.0085,000.0085,000.00深圳证交所1800,000.0080,000.0480,000.04小计1800,000.0080,000.0480,000.04合计32,000,000.00165,000.04165,000.04A股B股A股B股期末数1,115,000.001,115,000.00719,999.96719,999.961,834,999.96种类期初数本期增加本期减少期末数开办费1,957,031.862,945,353.101,209,021.793,693,363.17系统软件工程649,160.1050,000.0074,628.89624,531.21房租0.008,189,713.68217,197.207,972,516.48装修工程0.0053,000.001,766.6651,233.34合计2,606,191.9611,238,066.781,502,614.5412,341,644.20注:期末数较期初数增加9,735,452.24元,增幅373.55%,主要是由于营业部装修费、房租和开办费增加所致。,主要是由于营业部装修费、房租和开办费增加所致。资产类别期初数期末数东风汽车96,000.0096,000.00奥迪轿车230,000.00230,000.00富康轿车100,000.000.00丰田越野车500,000.000.00林肯轿车(蓝)680,000.00680,000.00本田雅阁(白)390,000.00390,000.00500,000.00500,000.00尼桑面包车(白)50,000.0050,000.00丰田轿车280,000.00280,000.00红旗轿车300,000.00300,000.00汉江轿车46,000.0046,000.001,160,000.001,160,000.00冻结资金530,000.000.00西安鑫元实业公司1,579,768.601,559,968.60北京业务处1,054,187.591,054,187.590.00322,500.000.008,715,268.000.00454,080.00合计7,495,956.1915,838,004.19皇冠3.0(黑)砖混房产681.92m2CQE红岩自卸车一辆砖混房产3,762.12m2砖混房产150.60m2注:期末数较期初数增加8,342,048元,增幅112.29%,主要是由于公司收到抵帐资产所致。备注湖南怀化抵帐资产湖南怀化抵帐资产龙马实业抵帐资产天源实业抵帐资产和熙餐饮抵帐资产和熙餐饮抵帐资产和熙餐饮抵帐资产和熙餐饮抵帐资产和熙餐饮抵帐资产吉元电工抵帐资产吉元电工抵帐资产湖南怀化抵帐资产投资款投资款海南赛格抵帐资产立大高科抵帐资产龙马贸易抵帐资产,主要是由于公司收到抵帐资产所致。单位名称金额年利率中国建设银行陕西省分行第二支行5,000,000.005.940%光大银行9,000,000.006.435%西安商业银行钟楼支行25,000,000.005.580%西安商业银行钟楼支行10,000,000.007.254%合计49,000,000.00期限备注1999.03.10--2001.03.092000.10.09--2001.09.182000.11.14--2001.05.232000.06.08--2001.03.08以1000万元宝鸡峡水利债券质押以2500万元财源经销部定期存单质押以1400万元马栏河水利债券质押类别期初数期末数余额占总额比例余额占总额比例应付款项14,695,158.99100%20,115,733.13100%合计14,695,158.99100%20,...