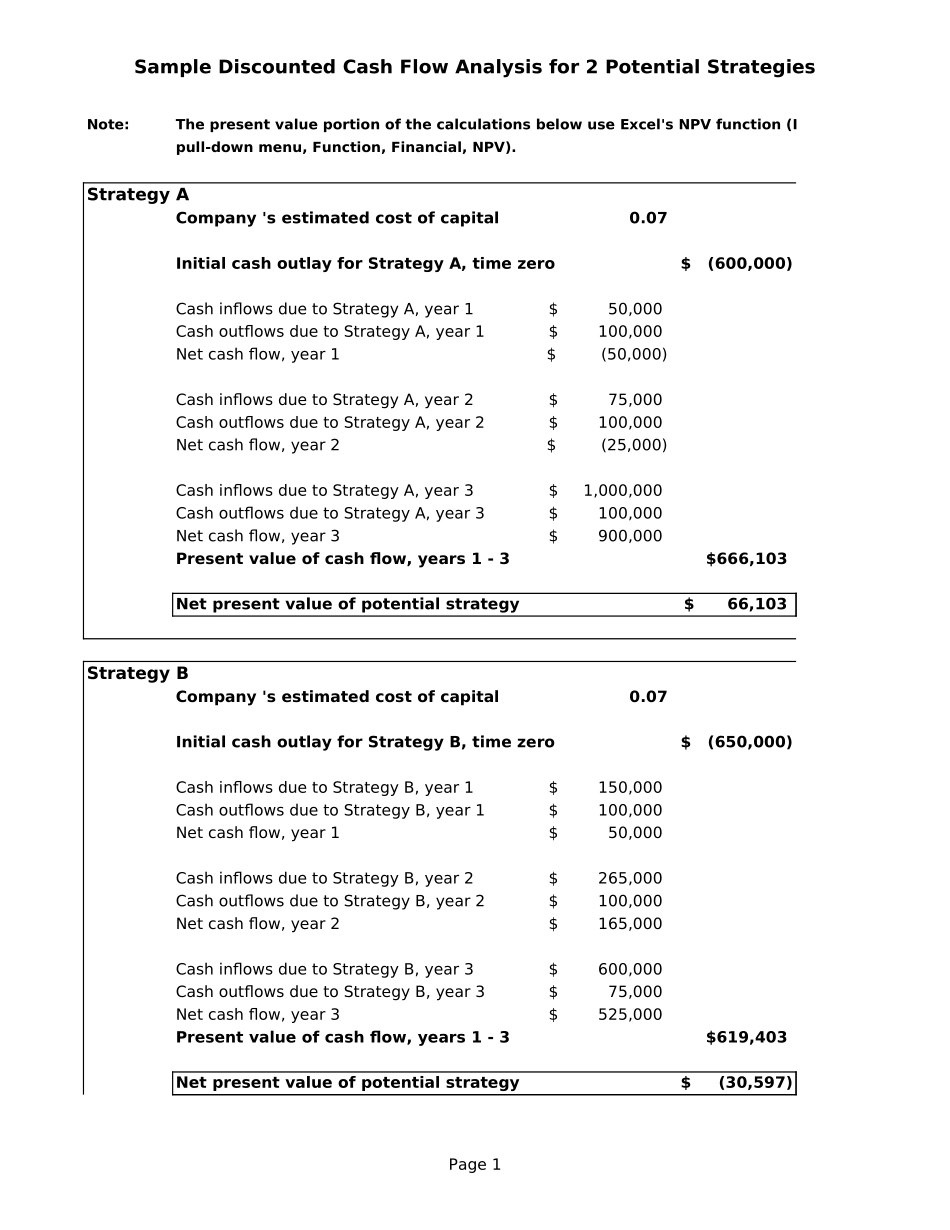

SampleDiscountedCashFlowAnalysisfor2PotentialStrategiesPage1Note:ThepresentvalueportionofthecalculationsbelowuseExcel'sNPVfunction(Insertpull-downmenu,Function,Financial,NPV).StrategyACompany'sestimatedcostofcapital0.07InitialcashoutlayforStrategyA,timezero$(600,000)CashinflowsduetoStrategyA,year1$50,000CashoutflowsduetoStrategyA,year1$100,000Netcashflow,year1$(50,000)CashinflowsduetoStrategyA,year2$75,000CashoutflowsduetoStrategyA,year2$100,000Netcashflow,year2$(25,000)CashinflowsduetoStrategyA,year3$1,000,000CashoutflowsduetoStrategyA,year3$100,000Netcashflow,year3$900,000Presentvalueofcashflow,years1-3$666,103Netpresentvalueofpotentialstrategy$66,103StrategyBCompany'sestimatedcostofcapital0.07InitialcashoutlayforStrategyB,timezero$(650,000)CashinflowsduetoStrategyB,year1$150,000CashoutflowsduetoStrategyB,year1$100,000Netcashflow,year1$50,000CashinflowsduetoStrategyB,year2$265,000CashoutflowsduetoStrategyB,year2$100,000Netcashflow,year2$165,000CashinflowsduetoStrategyB,year3$600,000CashoutflowsduetoStrategyB,year3$75,000Netcashflow,year3$525,000Presentvalueofcashflow,years1-3$619,403Netpresentvalueofpotentialstrategy$(30,597)SampleDiscountedCashFlowAnalysisfor2PotentialStrategiesPage2StrategyAhasapositivenetpresentvalue,whileStrategyB'sNPVisnegative.ThisshouldbetakenintoaccountwhenselectinganappropriatestrategyfortheCompany.SampleDiscountedCashFlowAnalysisfor2PotentialStrategiesPage3ThepresentvalueportionofthecalculationsbelowuseExcel'sNPVfunction(InsertSampleDiscountedCashFlowAnalysisfor2PotentialStrategiesPage4ThisshouldbetakenintoaccountwhenselectinganappropriatestrategyfortheCompany.